Question: This chapter explained two methods to evaluate investments using recovery time, the payback period and break-even time (BET). Refer to QS 25-14 and (1) compute

This chapter explained two methods to evaluate investments using recovery time, the payback period and break-even time (BET). Refer to QS 25-14 and (1) compute the recovery time for both the payback period and break-even time, (2) discuss the advantage(s) of break-even time over the payback period, and (3) list two conditions under which payback period and break-even time are similar.

Data From Exercise 25-14:

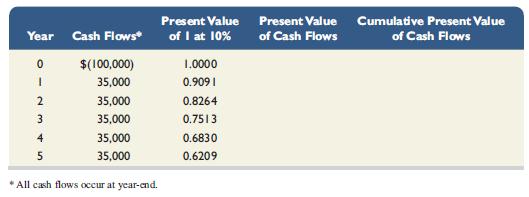

Soles, a shoe manufacturer, is evaluating the costs and benefits of new equipment that would custom fit each pair of athletic shoes. The customer would have his or her foot scanned by digital computer equipment; this information would be used to cut the raw materials to provide the customer a perfect fit. The new equipment costs $100,000 and is expected to generate an additional $35,000 in cash flows for five years. A bank will make a $100,000 loan to the company at a 10% interest rate for this equipment’s purchase. Use the following table to determine the break-even time for this equipment. (Round the present value of cash flows to the nearest dollar.)

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

1 Compute the recovery time for both the payback period and breakeven time To calculate the payback period we need to determine the number of years it ... View full answer

Get step-by-step solutions from verified subject matter experts