Question: Using the adjusted trial balance in Problem 4-6B, prepare the income statement, statement of changes in equity, and classified balance sheet. Analysis Component: Why must

Using the adjusted trial balance in Problem 4-6B, prepare the income statement, statement of changes in equity, and classified balance sheet.

Analysis Component: Why must liabilities be separated on the balance sheet between current and noncurrent? What effect would it have had on Sale?s balance sheet if the non-current notes were not separated?

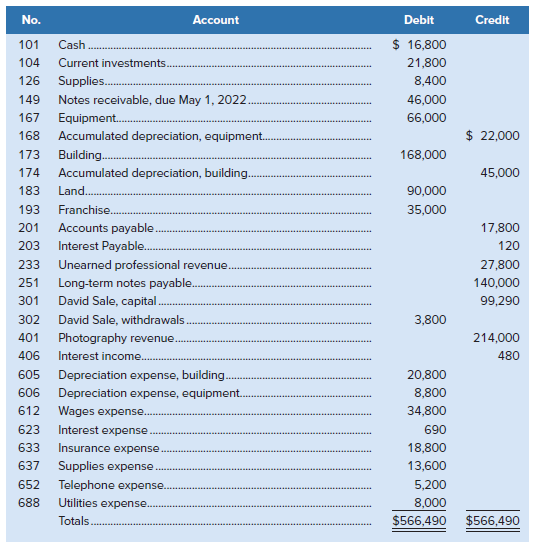

Problem 4-6B

The adjusted trial balance for Destination Wedding Photo as of December 31, 2020, follows:

No. Account Debit Credit $ 16,800 101 Cash Current investments. 104 21,800 8,400 126 Supplies. 46,000 66,000 149 Notes receivable, due May 1, 2022. 167 Equipment. $ 22,000 Accumulated depreciation, equipment. 168 168,000 173 Building. Accumulated depreciation, building. 45,000 174 90,000 183 Land. 193 Franchise. 35,000 Accounts payable. 201 17,800 203 Interest Payable. 120 Unearned professional revenue. 233 27,800 Long-term notes payable. David Sale, capital. 251 140,000 301 99,290 302 David Sale, withdrawals. 3,800 401 Photography revenue. 214,000 406 Interest income. 480 605 Depreciation expense, building. 20,800 606 Depreciation expense, equipment. 8,800 34,800 612 Wages expense. Interest expense 690 623 18,800 633 Insurance expense Supplies expense. Telephone expense. 637 13,600 5,200 652 Utilities expense. 8,000 688 Totals. $566,490 $566,490

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

DESTINATION WEDDING PHOTO Income Statement For Year Ended December 31 2020 Revenues Photography revenue 214000 Interest income 480 Total revenues 2144... View full answer

Get step-by-step solutions from verified subject matter experts