Question: Using the information from Problem 4-2B, prepare an income statement and a statement of changes in equity for the year ended December 31, 2023, and

Using the information from Problem 4-2B, prepare an income statement and a statement of changes in equity for the year ended December 31, 2023, and a classified balance sheet at December 31, 2023. The owner made no investments during the year.

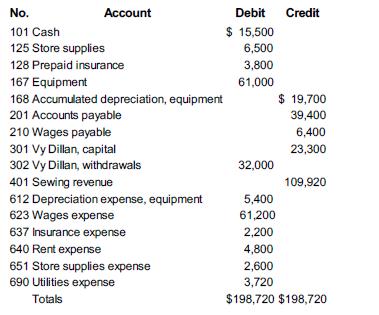

Data From Problem 4-2B

The adjusted trial balance for Dillan’s Tailoring Services on December 31, 2023, appears as follows:

Analysis Component:

Dillan’s Tailoring Services experienced a profit during 2023. If you were one of the business’s creditors, would you conclude that because of this profit Dillan’s Tailoring will pay its obligations in 2024?

No. 101 Cash 125 Store supplies 128 Prepaid insurance Account 167 Equipment 168 Accumulated depreciation, equipment 201 Accounts payable 210 Wages payable 301 Vy Dillan, capital 302 Vy Dillan, withdrawals 401 Sewing revenue 612 Depreciation expense, equipment 623 Wages expense 637 Insurance expense 640 Rent expense 651 Store supplies expense 690 Utilities expense Totals Debit Credit $ 15,500 6,500 3,800 61,000 32,000 $ 19,700 39,400 6,400 23,300 109,920 5,400 61,200 2,200 4,800 2,600 3,720 $198,720 $198,720

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Analysis component Profit is not a guarantee that a business can meet its current obligations As a c... View full answer

Get step-by-step solutions from verified subject matter experts