Question: Using the information in Problem 3-9B, complete the following: 1. Set up balance column accounts for Hallmark Surveying Services and enter the balances listed in

Using the information in Problem 3-9B, complete the following:

1. Set up balance column accounts for Hallmark Surveying Services and enter the balances listed in the unadjusted trial balance.

2. Post the adjusting entries prepared in Problem 3-9B to the balance column accounts.

3. Prepare an adjusted trial balance.

4. Use the adjusted trial balance to prepare an income statement, a statement of changes in equity, and a balance sheet. Assume that the owner, Ben Hallmark, made owner investments of $4,000 during the month.

Analysis Component: At December 31, 2020, how much of the business’s assets are financed by the owner? by debt? Assuming total assets at the end of the previous month totalled $84,200, did equity financing increase or decrease during December? Generally speaking, is this a favourable or unfavourable change?

For Part 1, your instructor may ask you to set up T-accounts instead of balance column accounts. The solution is available in both formats.

Problem 3-9

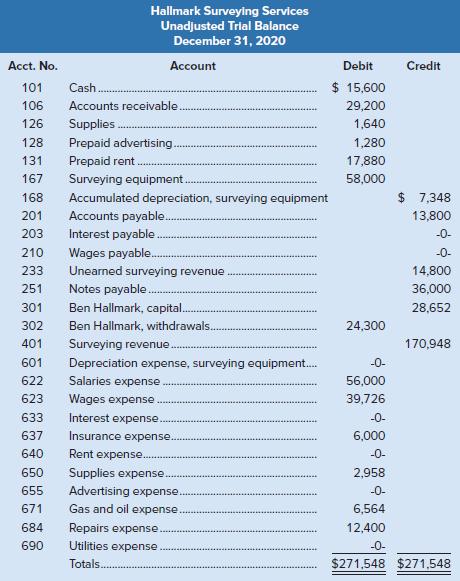

Ben Hallmark, the owner of Hallmark Surveying Services, has been in business for two years. The unadjusted trial balance at December 31, regarding the month just ended, follows.

Hallmark Surveying Services Unadjusted Trial Balance December 31, 2020 Acct. No. Account Debit Credit 101 Cash. $ 15,600 106 Accounts receivable. 29,200 126 Supplies 1,640 128 Prepaid advertising.. 1,280 131 Prepaid rent. 17,880 167 Surveying equipment. 58,000 168 Accumulated depreciation, surveying equipment $ 7,348 201 Accounts payable. 13,800 Interest payable . Wages payable. Unearned surveying revenue. Notes payable. 203 -0- 210 -0- 233 14,800 251 36,000 Ben Hallmark, capital. Ben Hallmark, withdrawals. 301 28,652 302 24,300 401 Surveying revenue 170,948 601 Depreciation expense, surveying equipment. -0- 622 Salaries expense 56,000 623 39,726 Wages expense Interest expense. 633 -0- 637 Insurance expense. 6,000 640 Rent expense. -0- 650 Supplies expense. 2,958 655 Advertising expense. -0- 671 Gas and oil expense 6,564 684 Repairs expense. 12,400 690 Utilities expense -0- Totals. $271,548 $271,548

Step by Step Solution

3.29 Rating (161 Votes )

There are 3 Steps involved in it

Parts 1 and 2 The solution to Parts 1 and 2 is also done using Taccounts and can be found immediately following the balance column format AJE A djusting J ournal E ntry After posting the December 31 2... View full answer

Get step-by-step solutions from verified subject matter experts