Connor Company sold 30,000 units of its only product for $28 per unit this year. Manufacturing and

Question:

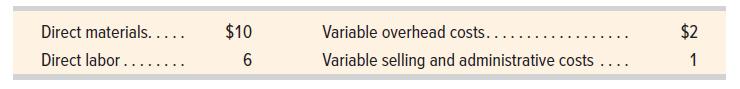

Connor Company sold 30,000 units of its only product for $28 per unit this year. Manufacturing and selling the product required $225,000 of fixed costs. Its per unit variable costs follow.

For the next year, management will use a new material, which will reduce direct materials costs to $8 per unit and reduce direct labor costs to $5 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change. Management is also considering raising its selling price to $30 per unit, which would decrease unit sales volume to 25,000 units.

Required

1. Compute the contribution margin per unit from

(a) Using the new material and

(b) Using the new material and increasing the selling price.

2. Prepare a contribution margin income statement for next year with two columns showing the expected results of

(a) using the new material and

(b) Using the new material and increasing the selling price.

Analysis Component

3. Using answers to part 2, should management raise the selling price?

Step by Step Answer: