General Ledger (GL) Assignments expose students to general ledger software similar to that in practice. GL is

Question:

General Ledger (GL) Assignments expose students to general ledger software similar to that in practice. GL is part of Connect, and GL assignments are auto-gradable and have algorithmic options. For the following GL assignments, prepare adjusting entries and determine their impact on net income. Financial statements are automatically generated based on entries recorded—this feature can be turned off.

GL 4-1 Transactions from the FastForward illustration in this chapter

GL 4-2 Based on Problem 4-1A

GL 4-3 Based on Problem 4-2A

GL 4-4 Based on Problem 4-6A

GL 4-5 Based on Serial Problem SP 4

Based on Problem 4-1A

On April 1., Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company’s first month.

Apr. 2. Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company.

3. The company rented furnished office space by paying $1,800 cash for the first month’s (April) rent.

4. The company purchased $1,000 of office supplies for cash.

10. The company paid $2,400 cash for a 12-month insurance policy. Coverage begins on April 11.

14. The company paid $1,600 cash for two weeks’ salaries earned by employees.

24. The company collected $8,000 cash for commissions revenue.

28. The company paid $1,600 cash for two weeks’ salaries earned by employees.

29. The company paid $350 cash for minor repairs to computer equipment.

30. The company paid $750 cash for this month’s telephone bill.

30. Nozomi withdrew $1,500 cash from the company for personal use.

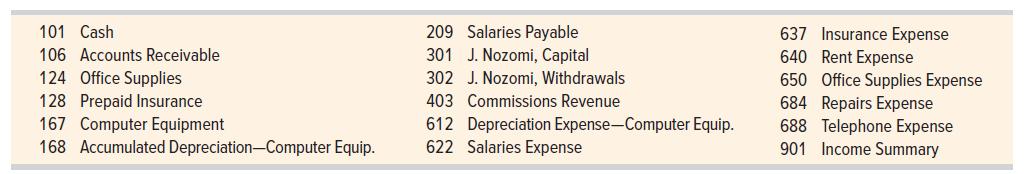

The company’s chart of accounts follows.

Required

1. Use the balance column format to set up each ledger account listed in its chart of accounts.

2. Prepare journal entries to record the transactions for April and post them to ledger accounts.

3. Prepare an unadjusted trial balance as of April 30.

4. Use the following information to journalize and post adjusting entries for the month.

a. Prepaid insurance of $133 expired this month.

b. At the end of the month, $600 of office supplies are still available.

c. This month’s depreciation on computer equipment is $500.

d. Employees earned $420 of unpaid and unrecorded salaries as of month-end.

e. The company earned $1,750 of commissions revenue that is not yet recorded at month-end.

5. Prepare the adjusted trial balance as of April 30. Prepare the income statement and the statement of owner’s equity for the month of April and the balance sheet at April 30.

6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

7. Prepare a post-closing trial balance.

Based on Problem 4-2A

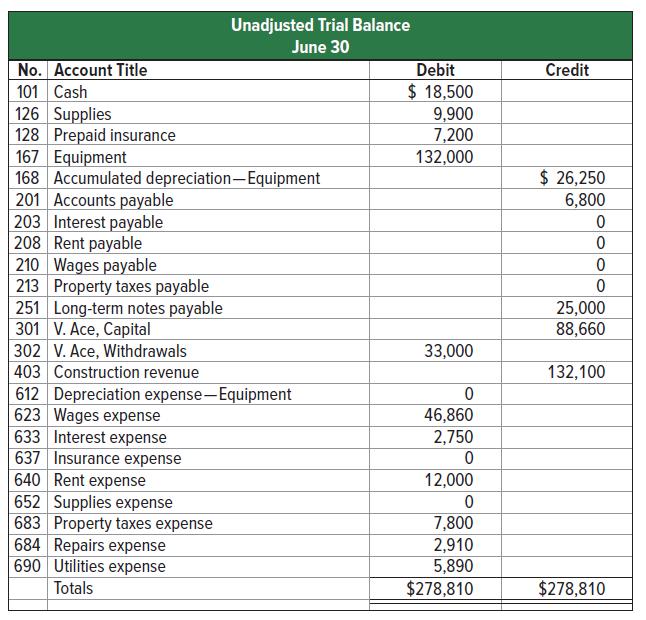

The following unadjusted trial balance is for Ace Construction Co. at its June 30 current fiscal year-end. The credit balance of the V. Ace, Capital account was $53,660 on June 30 of the prior year, and the owner invested $35,000 cash during the current fiscal year.

Required

1. Prepare and complete a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the following additional information.

a. Supplies available at the end of the current fiscal year total $3,300.

b. Cost of expired insurance for the current fiscal year is $3,800.

c. Annual depreciation on equipment is $8,400.

d. June utilities expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $650 amount owed must be recorded.

e. Employees have earned $1,800 of accrued and unpaid wages at fiscal year-end.

f. Rent expense incurred and not yet paid or recorded at fiscal year-end is $500.

g. Additional property taxes of $1,000 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end.

h. $250 accrued interest for June has not yet been paid or recorded.

2. Using information from the completed 10-column work sheet in part 1, journalize the adjusting entries and the closing entries.

3. Prepare the income statement and the statement of owner’s equity for the year ended June 30 and the classified balance sheet at June 30.

Based on Problem 4-6A

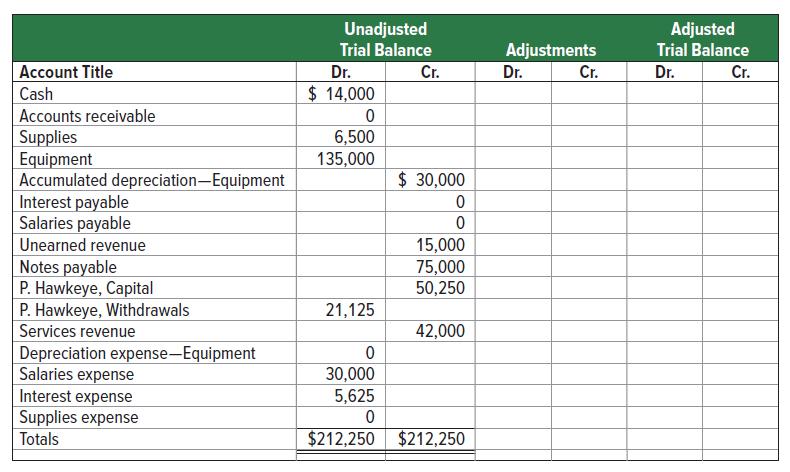

The following six-column table for Hawkeye Ranges includes the unadjusted trial balance as of December 31.

Required

1. Complete the six-column table by entering adjustments that reflect the following information.

a. As of December 31, employees had earned $1,200 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,500 of salaries will be paid.

b. Cost of supplies still available at December 31 total $3,000.

c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,875. The next interest payment, at an amount of $2,250, is due on January 15.

d. Analysis of Unearned Revenue shows $5,800 remaining unearned at December 31.

e. Revenue of $9,300 is accrued for services provided. Payment will be collected on January 31.

f. Depreciation expense is $15,000.

2. Prepare journal entries for adjustments entered in the six-column table for part 1.

3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals.

4. Prepare journal entries to record cash payments and cash collections described in part 1 for January.

Based on Serial Problem SP 4

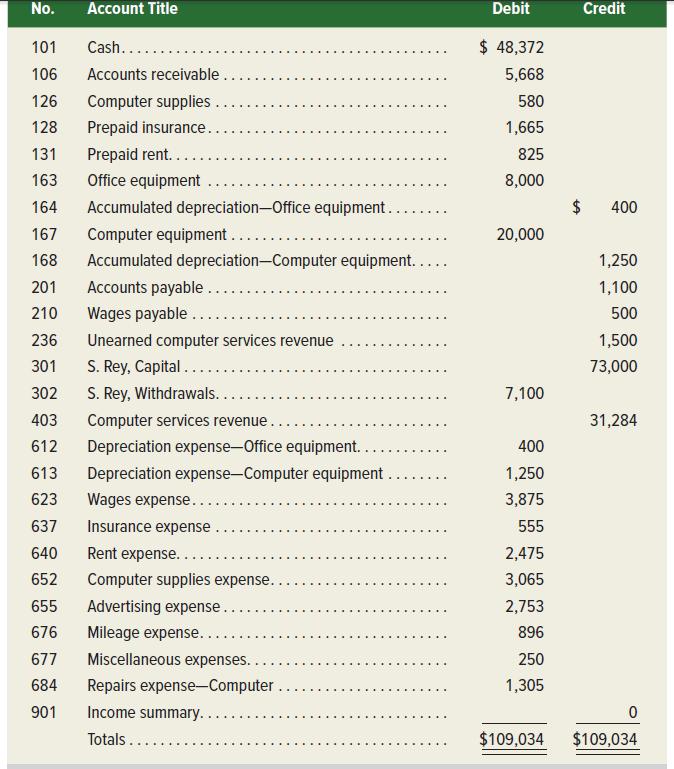

The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows.

Required

1. Prepare an income statement for the three months ended December 31, 2021.

2. Prepare a statement of owner’s equity for the three months ended December 31, 2021. Hint: The S. Rey, Capital account balance was $0 on October 1, and owner investments were $73,000 this period.

3. Prepare a classified balance sheet as of December 31, 2021.

4. Record and post the necessary closing entries as of December 31, 2021.

5. Prepare a post-closing trial balance as of December 31, 2021

Step by Step Answer: