Oneida Companys operations began in August. August sales were $215,000 and purchases were $125,000. The beginning cash

Question:

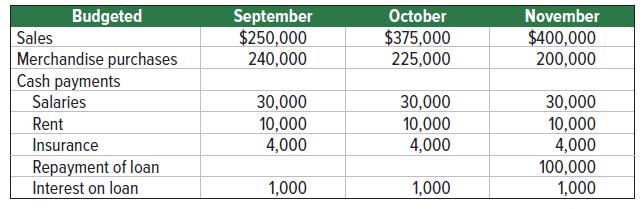

Oneida Company’s operations began in August. August sales were $215,000 and purchases were $125,000. The beginning cash balance for September is $5,000. Oneida’s owner approaches the bank for a $100,000 loan to be made on September 2 and repaid on November 30. The bank’s loan officer asks the owner to prepare monthly cash budgets. Its budgeted sales, merchandise purchases, and cash payments for other expenses for the next three months follow.

All sales are on credit where 70% of credit sales are collected in the month following the sale, and the remaining 30% collected in the second month following the sale. All merchandise is purchased on credit; 80% of the balance is paid in the month following a purchase, and the remaining 20% is paid in the second month.

Required

Prepare the following for the months of September, October, and November.

1. Schedule of cash receipts from sales.

2. Schedule of cash payments for direct materials.

3. Cash budget.

Step by Step Answer: