Safety-First Company completed all of its October 31, 2023, adjustments in preparation for preparing its financial statements,

Question:

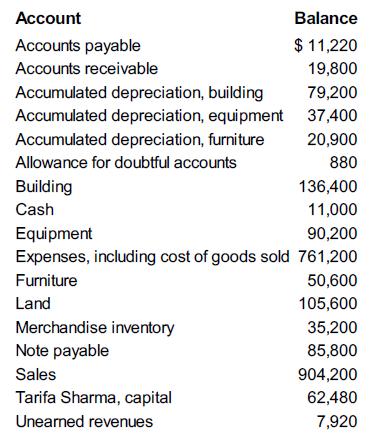

Safety-First Company completed all of its October 31, 2023, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance.

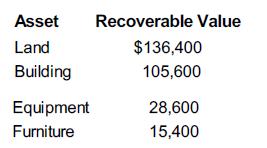

Other information:1. All accounts have normal balances.2. $26,400 of the note payable balance is due by October 31, 2024.The final task in the year-end process was to assess the assets for impairment, which resulted in the following schedule.

Required1. Prepare the entry (entries) to record any impairment losses at October 31, 2023. Assume the company recorded no impairment losses in previous years.2. Prepare a classified balance sheet at October 31, 2023.

Analysis Component:What is the impact on the financial statements of an impairment loss?

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris