Stoll Co.s long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters

Question:

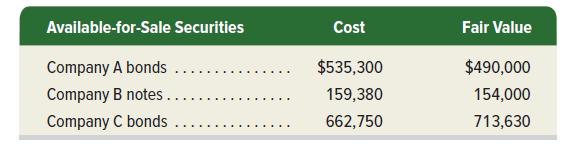

Stoll Co.’s long-term available-for-sale portfolio at the start of this year consists of the following.

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

Jan. 29 Sold one-half of the Company B notes for $79,200.

July 6 Purchased Company X bonds for $126,600.

Nov. 13 Purchased Company Z notes for $267,900.

Dec. 9 Sold all of the Company A bonds for $515,000.

Fair values at December 31 are

B, $81,000;

C, $665,000;

X, $118,000; and

Z, $278,000.

Required

1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities.

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll report on its income statement for this year?

Step by Step Answer: