Consider the following abbreviated financial statements for Barrie Enterprises: a. What is owners equity for 2011 and

Question:

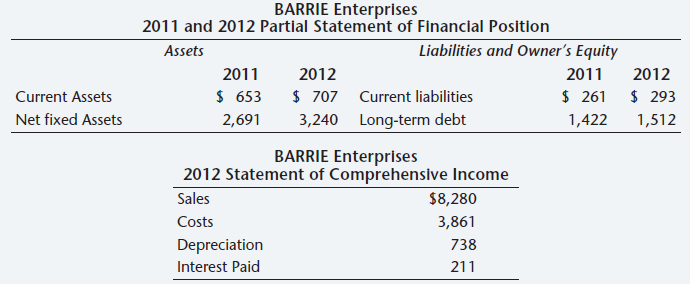

Consider the following abbreviated financial statements for Barrie Enterprises:

a. What is owner’s equity for 2011 and 2012?

b. What is the change in net working capital for 2012?

c. In 2012, Barrie Enterprises purchased $1,350 in new fixed assets. How much in fixed assets did Barrie Enterprises sell? What is the cash flow from assets for the year? (The tax rate is 35 percent.)

d. During 2012, Barrie Enterprises raised $270 in new long-term debt. How much long-term debt must Barrie Enterprises have paid off during the year? What is the cash flow to creditors?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Cash Flow From Assets

Cash flow from assets is the aggregate total of all cash flows related to the assets of a business. This information is used to determine the net amount of cash being spun off by or used in the operations of a business. The concept is comprised of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted: