Redo Problem 27 using sales growth rates of 30 and 35 percent in addition to 20 percent.

Question:

Redo Problem 27 using sales growth rates of 30 and 35 percent in addition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, and use this graph to determine the relationship between them. At what growth rate is the EFN equal to zero? Why is this sustainable growth rate different from that found by using the equation in the text?

Data From Problem 27:

In Problem 25, suppose the firm wishes to keep its debt–equity ratio constant. What is EFN now?

Data From Problem 25:

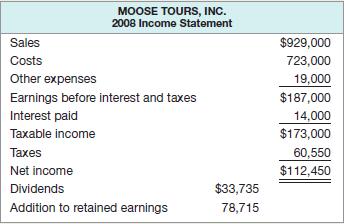

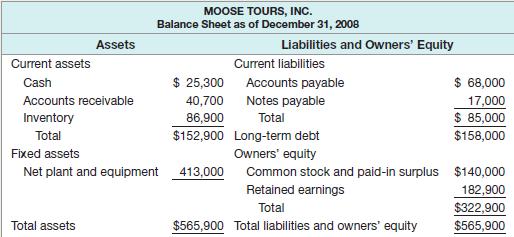

The most recent financial statements for Moose Tours, Inc., follow. Sales for 2009 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales?

Step by Step Answer:

Fundamentals of corporate finance

ISBN: 978-0073382395

9th edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan