Consider the information in Problem 10-56. The sales manager of Red Oak Chemicals has proposed to the

Question:

Consider the information in Problem 10-56. The sales manager of Red Oak Chemicals has proposed to the purchasing manager at JFI that Red Oak be given an exclusive contract to supply the feedstock. If it receives the contract, Red Oak will guarantee an 80 percent yield on the feedstock it supplies.

Required

a. Assume that the average quality, measured by the yield, and prices from the two companies will continue as in the past. What is the maximum price for feedstock that JFI should be willing to pay Red Oak under the exclusive contract?

b. Are there other factors that JFI should consider before accepting the offer?

Data From Problem 10-56:

JFI Foods produces processed foods. Its basic ingredient is a feedstock that is mixed with other ingredients to produce the final packaged product. JFI purchases the feedstock from two suppliers, Rex Materials and Red Oak Chemicals. The quality of the final product depends directly on the quality of the feedstock. If the feedstock is not correct, JFI has to dispose of the entire batch. All feedstock in this business is occasionally “bad,” so JFI measures what it calls the “yield,” which is measured as

Yield = Good output ÷ Input

where the output and inputs are both measured in tons. As a benchmark, JFI expects to get 8 tons of good output for every 10 tons of feedstock purchased for a yield of 80 percent (= 8 tons of output ÷ 10 tons of feedstock).

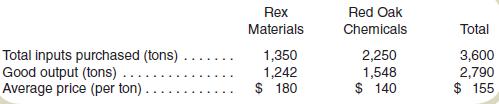

Data on the two suppliers for the past year follow:

Step by Step Answer:

Fundamentals of Cost Accounting

ISBN: 978-1259565403

5th edition

Authors: William Lanen, Shannon Anderson, Michael Maher