Corner Brook Furniture Co. makes bookstands and expects sales and collections for the first three months of

Question:

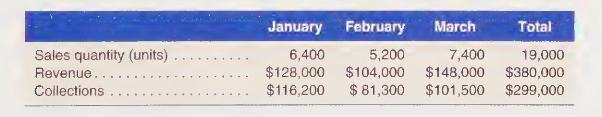

Corner Brook Furniture Co. makes bookstands and expects sales and collections for the first three months of 2021 to be as follows:

The December 31, 2020, balance sheet revealed the following selected account balances: Cash, \\($18,320;\) Direct Material Inventory, \\($8,230\); Finished Goods Inventory, \\($23,200\); and Accounts Payable, \(\$ 5,800\). The Direct Material Inventory balance represents 1,580 pounds of scrap iron and 1,200 bookstand bases. The Finished Goods Inventory consists of 1,220 bookstands.

Each bookstand requires two pounds of scrap iron, which costs \(\$ 3\) per pound. Bookstand bases are purchased from a local lumber mill at a cost of \(\$ 2.50\) per unit. Company management decided that, beginning in 2021, the ending balance of Direct Material Inventory should be 25 percent of the following month's production requirements and that the ending balance of Finished Goods Inventory should be 20 percent of the next month's sales. Sales for April and May are expected to be 8,000 bookstands per month.

The company normally pays for 75 percent of a month's purchases of direct material in the month of purchase (on which it takes a 1 percent cash discount). The remaining 25 percent is paid in full in the month following the month of purchase.

Direct labor is budgeted at \(\$ 0.70\) per bookstand produced and is paid in the month of production. Total cash manufacturing overhead is budgeted at \(\$ 14,000\) per month plus \(\$ 1.30\) per bookstand. Total cash selling and administrative costs equal \(\$ 13,600\) per month plus 10 percent of sales revenue. These costs are all paid in the month of incurrence. In addition, the company plans to pay executive bonuses of \(\$ 35,000\) in January 2021 and make an estimated quarterly tax payment of \(\$ 5,000\) in March 2021.

Management requires a minimum cash balance of \(\$ 10,000\) at the end of each month. If the company borrows funds, it will do so only in \(\$ 1,000\) multiples at the beginning of a month at a 12 percent annual interest rate. Loans are to be repaid at the end of a month in multiples of \(\$ 1,000\). Interest is paid only when a repayment is made. Investments are made in \(\$ 1,000\) multiples at the end of a month, and the return on investment is 8 percent per year.

a. Prepare a production budget by month and in total for the first quarter of 2021.

b. Prepare a direct material purchases budget by month and in total for the first quarter of 2021 .

c. Prepare a schedule of cash payments for purchases by month and in total for the first quarter of 2021 .

d. Prepare a combined payments schedule for manufacturing overhead and selling and administrative cash costs for each month and in total for the first quarter of 2021.

e. Prepare a cash budget for each month and in total for the first quarter of 2021.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9781618533531

10th Edition

Authors: Amie Dragoo, Michael Kinney, Cecily Raiborn