Four years ago, based on a pre-tax NPV analysis, Harper Inc. decided to add new equipment with

Question:

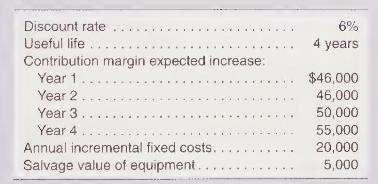

Four years ago, based on a pre-tax NPV analysis, Harper Inc. decided to add new equipment with a cost of \(\$ 85,000\), allowing the company to expand its product offerings. The data used in the analysis were as follows:

The management team decided to conduct a postinvestment audit to assess the accuracy of the planning process. The team is expecting the net present value to be better than expected because they were able to decrease fixed costs to \(\$ 16,000\) based upon renegotiated contracts. Actual contribution margin for years \(1,2,3\), and 4 were \(\$ 40,000, \$ 42,000, \$ 48,000\) and \(\$ 48,000\), respectively. Due to the unexpected market changes, the equipment does not have a salvage value.

a. Determine the original projected NPV on the product line investment.

b. Determine the actual NPV of the project based on the postinvestment audit.

c. Identify the factors that are most responsible for the differences between the projected NPV and the actual post investment audit NPV.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9781618533531

10th Edition

Authors: Amie Dragoo, Michael Kinney, Cecily Raiborn