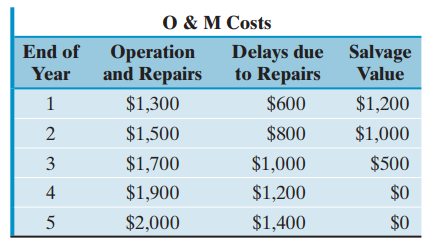

A six-year old CNC machine that originally cost $8,000 has been fully depreciated, and its current market

Question:

It is suggested that the machine be replaced by a new CNC machine of improved design at a cost of $6,000. It is believed that this purchase will completely eliminate breakdowns, and the resulting combined savings in delays, operation, and repairs will be a reduction of $200 more a year at each age than is the case with the old machine. Assume a five-year life and a $1,000 terminal salvage value for the challenger. The new machine falls into the five-year MACRS property class. The firm€™s MARR is 12%, and its marginal tax rate is 30%. Should the old machine be replaced now?

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: