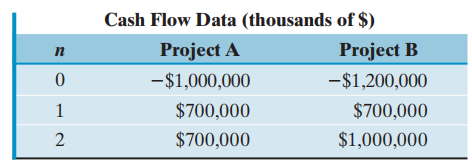

Consider the following cash flow data for two competing investment projects: (a) At i = 12%, which

Question:

(a) At i = 12%, which of the two projects would be a better choice?

(b) At i = 22%, which project is chosen by the NPW rule?

Transcribed Image Text:

Cash Flow Data (thousands of $) Project A Project B -$1,200,000 -$1,000,000 $700,000 $700,000 $700,000 $1,000,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

a Select project B b Sel...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the following cash flow diagram. What value of C makes the inflow series equivalent to the outflow series at an interest rate of 12% compounded annually? $1,200 $1,200 $1,200 $1,200 $800...

-

Use the following cash flow data for Rocket Transport to find Rockets a. Net cash provided by or used in investing activities. b. Net cash provided by or used in financing activities. c. Net increase...

-

Consider the following cash flow series. Determine the required annual deposits (end of year) that will generate the cash flows from years 4 to 7. Assume the interest rate is 6%, compounded monthly....

-

Describe the Spanish Theocratic Rule during Spain's colonial era in the Philippines?

-

In what direction relative to a magnetic field does a charged particle move in order to experience maximum deflecting force? Minimum deflecting force?

-

A humidifier uses a rotating disk of radius r, which is partially submerged in water. The most evaporation occurs when the exposed wetted region (shown as the upper shaded region in Figure 26) is...

-

The velocity profile for turbulent flow in circular pipes is often approximated by the \(1 / 7\) thpower law: \[\bar{v}_{z}=v_{\max }(1-r / R)^{1 / 7}\] Find an expression for the cross-sectionally...

-

Create a TaxReturn class with fields that hold a taxpayers Social Security number, last name, first name, street address, city, state, zip code, annual income, marital status, and tax liability....

-

Solve the following recurrence relations. You may use any method discussed in class, but you need to justify your answers by showing all relevant details. If you use a guess-and-prove method,...

-

Briefly describe the following items related to financial reporting by (a) Private not-for-profit health care entities; (b) Government-owned health care entities; (c) Commercial health care entites:...

-

Consider the following two mutually exclusive investment projects: Assume that the MARR = 12%. (a) Which alternative would you select by using the NPW criterion? (b) Which alternative would you...

-

Consider the following two mutually exclusive projects: (a) At an interest rate of 25%, which project would you recommend choosing? (b) Compute the area of negative project balance, discounted...

-

A company that manufactures toothpaste is studying five different package designs. Assuming that one design is just as likely to be selected by a consumer as any other design, what selection...

-

The corporate life cycle has 4 stages. In stage 2 a corporation is more likely to issue 1. very high cash divid 2. very low cash dividends 3. Stock dividend 4. buy back stock

-

Most state and local governments prepare two separate budgets: operating and capital budgets. Offer a comparison of operating versus capital budgets in the public sector. What are some examples of...

-

Buffalo Alkali and Plastics Buffalo Alkali and Plastics, a prominent producer of soda ash, began operations in the United States in 1880 using the Solvay Process. Buffalo, New York, was selected as...

-

For the group application work, build a Regnier Abacus with around 6 questions, aimed at prospecting information about the attributes of the product. Add a comment about the difficulties you may have...

-

Select the TRUE statement concerning professional corporations. A. Licensed professionals are the only individuals who can own shares. B. They are automatically taxed like partnerships. C. They are...

-

What is the ratio of the suns gravitational force on you to the earths gravitational force on you?

-

Drainee purchases direct materials each month. Its payment history shows that 65% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment...

-

What are the business benefits of using intelligent techniques for knowledge management? a. Define an expert system, describe how it works, and explain its value to business. b. Define case-based...

-

What are the different types of decisions, and how does the decision-making process work? a. List and describe the different levels of decision making and decision-making constituencies in...

-

How do information systems support the activities of managers and management decision making? a. Compare the descriptions of managerial behavior in the classical and behavioral models. b. Identify...

-

Georgias employee will match her contributions into a retirement plan up to 5% of her 40,000 annual salary. in other words, the employee will put $1 into her retirement plan for every $1 Georgia puts...

-

Stock in Country Road Industries has a beta of 1.09. The market risk premium is 7.5 percent, and T-bills are currently yielding 3.5 percent. The company's most recent dividend was $1.7 per share, and...

-

Festival Dancing and Fitness In this activity, you will be provided with a review on the implication of dancing activity to your fitness by way of determining your range of Target Heart Rate. Let us...

Study smarter with the SolutionInn App