Consider the following investment cash flows over a threeyear life: (a) If all cash flows are mutually

Question:

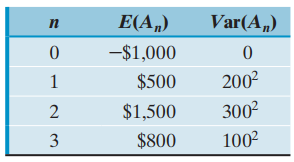

(a) If all cash flows are mutually independent, compute E(NPW) and Var(NPW) at i = 10%.

(b) If all annual cash flows are normally distributed with the means and variances as previously specified, compute the probability that the project will make a profit higher than its expected NPW.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: