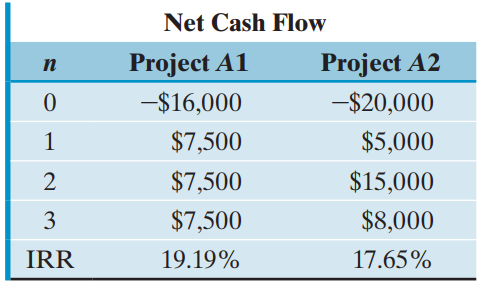

Consider the following two mutually exclusive investment alternatives: (a) Determine the IRR on the incremental investment in

Question:

(a) Determine the IRR on the incremental investment in the amount of $4,000. (Assume that MARR = 10%.)

(b) If the firm€™s MARR is 10%, which alternative is the better choice?

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Net Cash Flow Project A1 Project A2 п -$16,000 -$20,000 $5,000 $7,500 $7,500 $15,000 $7,500 $8,000 3 IRR 19.19% 17.65%

Step by Step Answer:

a IRR A2 A1 1308 b Select ...View the full answer

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Consider the following two mutually exclusive projects: a. Calculate the NPV of each project for discount rates of 0, 10, and 20 percent. Plot these on a graph with NPV on the vertical axis and...

-

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you require a 15 percent return on your investment. (a) If you apply the payback criterion, which...

-

Consider the following two mutually exclusive projects. Whichever project you choose, if any, you require a 15 percent return on your investment. a. If you apply the payback criterion, which...

-

Thomas Gilbert and Susan Bradley formed a professional corporation called Financial Services Inc.A Professional Corporation, each taking 50 percent of the authorized common stock. Gilbert is a CPA...

-

In a game of baseball, a player hits a high fly ball to the outfield. (a) Is there a point during the flight of the ball where its velocity is parallel to its acceleration? (b) Is there a point where...

-

The following financial statement was prepared by employees of Walters Corporation. Note 1: New styles and rapidly changing consumer preferences resulted in a $71,500 loss on the disposal of...

-

Using the method of subregions, derive an equation for the transverse modulus, \(E_{2}\), for the RVE, which includes a fiber/matrix interphase region, as shown in Figure 3.27. Matrix Fiber Sed d...

-

Haldane Company estimates that its overhead costs for 2014 will be $360,000 and output in units of product will be 300,000 units. Required a. Calculate Haldanes predetermined overhead rate based on...

-

centum Ltd has prepared its consolidated financial statements for the year 30th September 2019 extracts of which are shown below. also provided below are extracts of the consolidated financial...

-

A regression model to predict the price of diamonds included the following predictor variables: the weight of the stone (in carats where 1 carat = 0.2 gram), the color rating (D, E, F, G, H, or I),...

-

Consider the following two investment alternatives: The firms MARR is known to be 15%. (a) Compute the IRR of Project B. (b) Compute the PW of Project A. (c) Suppose that Projects A and B are...

-

Suppose a business is considering the purchase of a $40,000 machine whose operation will result in increased sales of $30,000 per year and increased operating costs of $10,000; additional profits...

-

Brown Company closes its books on October 31. On September 30 the Notes Receivable account balance is $20,200. Notes Receivable include the following. Interest is computed using a 360-day year....

-

In March of 2023, Goldman Sachs published a report., indicating that ~25% of the tasks in US and Europe can be automated using AI. However, not all industries will be affected equally. According to...

-

Given O dy dx dy dx dy sin x (xe* + e*) dx cos x cos x (xex + e*) - sin x dy dx || y = = xex cos x Find xex + ex sin x dy dx cos x (xe* + e*) + xe* sin x cos x

-

2. A solid propellant motor has the following properties: a port circum- ference of 0.3 m, a burn rate of 1.2 cm/s, a propellant density of 1875 kg/m, an initial combustion chamber pressure of 12...

-

1- Using MATLAB plot the time domain and frequency domain response for DSB-FC signal if m(t) is sinusoidal signal with frequency fm=100 Hz and sinusoidal carrier signal with frequency of 1000Hz. Use...

-

A heat exchanger connects two pieces of machinery. The right end of the exchanger (x = 0), is held at a constant temperature, Tref. The left end is insulated. Along the exchanger's length, heat is...

-

Consider the following two investment alter-natives. Determine the range of investment costs for Alternative B (i.e., min. value < X < max. value) that will convince an investor to select Alternative...

-

Refer to the data for problem 13-36 regarding Long Beach Pharmaceutical Company. Required: Compute each division's residual income for the year under each of the following assumptions about the...

-

List three products that are sold in purely competitive markets and three that are sold in monopolistically competitive markets. Do any of these products have anything in common? Can any...

-

Cite a local example of an oligopoly, explaining why it is an oligopoly.

-

Distinguish between the following pairs of items that appear on operating statements: (a) Gross sales and net sales, (b) Purchases at billed cost and purchases at net cost.

-

1. What is difference between Torque and Force? Explain with one example of each. 2. What is difference between linear momentum and angular momentum? Explain with one example of each. 3(a) What is...

-

On August 30, JumpStart paid the following expenses: August rent, $2,300 August's utility bill, $525 Employee wages, $1,750 Parking lot cleaning fee, $27 Journalize these payments as one journal...

-

A 700 g ball strikes a wall at 15.1 m/s and rebounds at 14.4 m/s. The ball is in contact with the wall for 0.034 s. What is the magnitude of the average force acting on the ball during the collision?...

Study smarter with the SolutionInn App