Tucson Solar Company builds residential solar homes. Because of an anticipated increase in business volume, the company

Question:

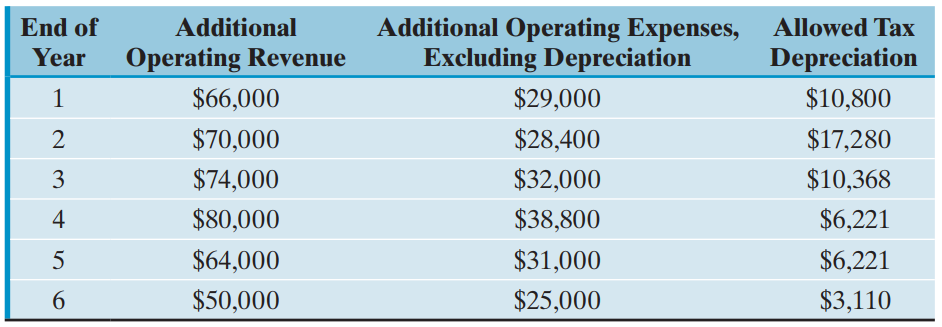

The projected revenue is assumed to be in cash in the year indicated, and all the additional operating expenses are expected to be paid in the year in which they are incurred. The estimated salvage value for the loader at the end of the sixth year is $8,000. The firm€™s incremental (marginal) tax rate is 35%.

(a) What is the after€tax cash flow if the loader is acquired?

(b) What is the equivalent annual cash flow the firm can expect by owning and operating this loader at an interest rate of 12%?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: