Assume that Fitness and Fun, Inc. reported the following information for the nine-month period ended September 30,

Question:

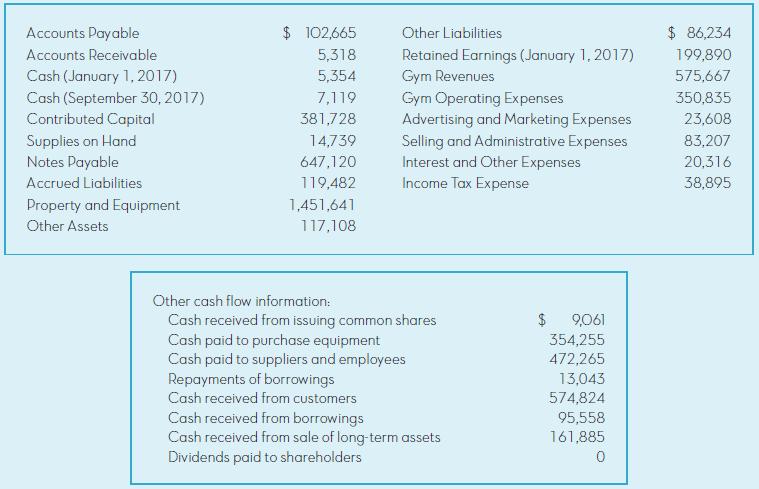

Assume that Fitness and Fun, Inc. reported the following information for the nine-month period ended September 30, 2017. Items are listed alphabetically and are in thousands of dollars.

Required:

Prepare the four basic financial statements for the nine months ended September 30, 2017.

a. Income statement

Net Income = $58,806,000

b. Statement of retained earnings

Closing Retained Earnings = $258,696,000

c. Balance sheet

Total Assets = $1,595,925,000

d. Statement of cash flows

Cash Provided by Operating Activities = $102,559,000

Cash Used in Investing Activities = $192,370,000

Cash Provided by Financing Activities = $91,576,000

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh