Ninja Sockeye Star prepared the following unadjusted trial balance at the end of its second year of

Question:

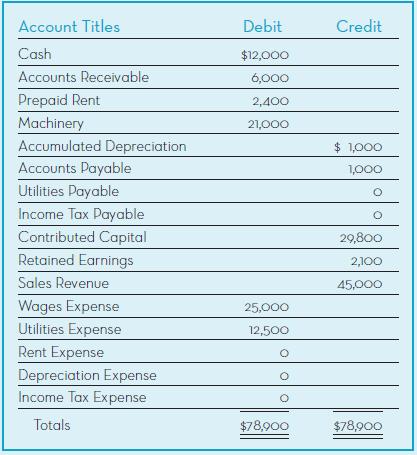

Ninja Sockeye Star prepared the following unadjusted trial balance at the end of its second year of operations, ending December 31, 2017.

Other data not yet recorded at December 31, 2017 includes the following:

a. Rent expired during 2017, $1,200

b. Depreciation expense for 2017, $1,000

c. Utilities payable, $9,000

d. Income tax expense, $800

Required:

1. Using the format shown in the demonstration case, indicate the accounting equation effects of each required adjustment.

2. Prepare the adjusting journal entries required at December 31, 2017.

3. Summarize the adjusting journal entries in T-accounts. After entering the beginning balances and computing the adjusted ending balances, prepare an adjusted trial balance as of December 31, 2017.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh