Question: Using Common Size Data for Credit Analysis} You are the credit manager for Balzac Supply Inc. One of your sales staff has made a ($

Using Common Size Data for Credit Analysis}

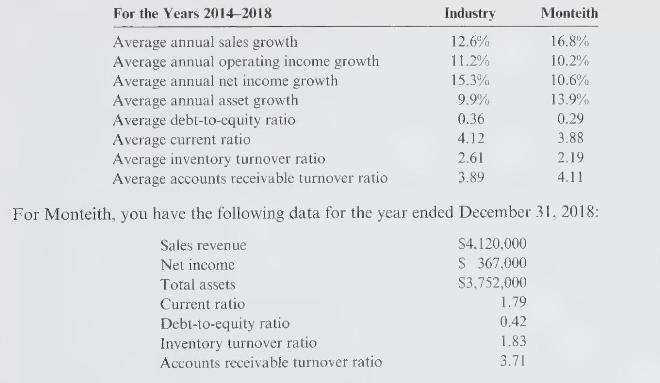

You are the credit manager for Balzac Supply Inc. One of your sales staff has made a \(\$ 60,000\) credit sale to Monteith Technology, a manufacturer of small computers. Your responsibility is to decide whether to approve the sale. You have the following data for the computer industry and Monteith:

The salesperson believes that Monteith would order about \(\$ 240,000\) per year of materials that would provide a gross margin of \(\$ 40,000\) to Balzac if reasonable credit terms could be arranged.

\section*{Required:}

CONCEPTUAL CONNECTION State whether or not you would grant authorization for Monteith to purchase on credit and support your decision.

\section*{Problem

For the Years 2014-2018 Industry Monteith Average annual sales growth 12.6% 16.8% Average annual operating income growth 11.2% 10.2% Average annual net income growth 15.3% 10.6% Average annual asset growth 9.9% 13.9% Average debt-to-equity ratio 0.36 0.29 Average current ratio 4.12 3.88 Average inventory turnover ratio 2.61 2.19 3.89 4.11 Average accounts receivable turnover ratio For Monteith, you have the following data for the year ended December 31, 2018: Sales revenue Net income Total assets Current ratio Debt-to-equity ratio Inventory turnover ratio Accounts receivable turnover ratio $4.120.000 S 367,000 $3,752,000 1.79 0.42 1.83 3.71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts