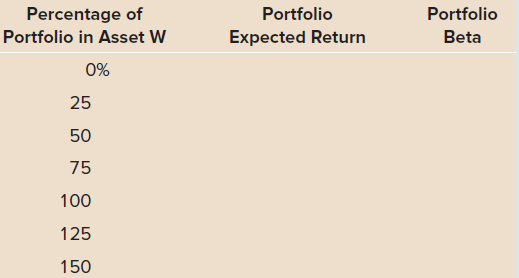

Asset W has an expected return of 12.0 percent and a beta of 1.1. If the risk-free

Question:

Transcribed Image Text:

Percentage of Portfolio Portfolio Portfolio in Asset W Expected Return Beta 0% 25 50 75 100 125 150

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

P x W 11 1 x W 0 11x W ER W 12 04 MRP110 MRP 0811...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

Asset W has an expected return of 10.5 percent and a beta of .9. If the risk-free rate is 6 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the...

-

An investment has an expected return of 12 percent per year with a standard deviation of 6 percent. Assuming that the returns on this investment are at least roughly normally distributed, how...

-

A portfolio has an expected return of 10.6 percent. This portfolio contains two stocks and one risk-free security. The expected return on stock X is 8.6 percent and on stock Y it is 23 percent. The...

-

Learning by doing is an integral part of the course experience albeit online. The intent of this assignment is for you to demonstrate your ability to apply course content. Thus in the Marketing...

-

How are elements with nuclei heavier than those of hydrogen and helium formed?

-

The following examples highlight the impact of differences in laws and social norms on various aspects of the marketing program. What are the implications of such differences for using standardized...

-

Referring to the nano twisting data in Exercise 11.24, calculate the correlation coefficient. Data From Exercise 11.24 11.24 Nanowires, tiny wires just a few millionths of a centimeter thick, which...

-

Multiple Choice Question Select the best answer for each of the following items and give reasons for your choice. a. Which of the following organizations can revoke the right of an individual to...

-

Letty, Brian, Han, Dominic, and Gisele loved driving around town fast and furious. If one happened to be speeding and noticed an officer or a state trooper, they would send signals to others to make...

-

Refer to Exercise 10. Here are summary statistics for the state median household incomes: a. Find and interpret the z-score for North Carolina, with a median household income of $41,553. b. New...

-

Stock Y has a beta of 1.05 and an expected return of 13 percent. Stock Z has a beta of 0.70 and an expected return of 9 percent. If the risk-free rate is 5 percent and the market risk premium is 7...

-

A share of stock sells for $35 today. The beta of the stock is 1.2 and the expected return on the market is 12 percent. The stock is expected to pay a dividend of $0.80 in one year. If the risk-free...

-

What is the amount of the personal and dependency exemptions for 2017?

-

4. How can the business use liquidity ratios, such as the current ratio, quick ratio, cash ratio, and working capital, as well as solvency ratios, like the debt-to-equity ratio, interest coverage...

-

Firm A has a margin of 1 0 % , sales of $ 5 1 0 , 0 0 0 , and ROI of 1 9 % . Calculate the firm's average total assets. Firm B has net income of $ 7 4 , 0 0 0 , asset turnover of 1 . 5 0 , and...

-

What generally happens to men and women's income and assets after divorce?

-

The following model assumes two countries in the world that are trading two goods: computers and automobiles. You are given the following relative supply and relative demand equations for a large...

-

Financial Statements: Explain the various financial statements needed to calculate a business's working capital. Also explain how to use each financial statement for the calculation. Give examples to...

-

Proportion of Reeses Pieces that are orange, using p = 0.48 with n = 150 Find a 95% confidence interval for the proportion two ways, using StatKey or other technology and percentiles from a bootstrap...

-

Explain the circumstances that could result in a long-term bank loan being shown in a statement of financial position as a current liability.

-

a. Explain the difference between systematic risk measured by beta and total risk measured by standard deviation. When are they essentially the same? b. What is a Sharpe-optimal portfolio? c. Among...

-

Conduct a regression analysis for the returns of the Fidelity Large Cap Stock Fund (FLCSX) on the S&P 500.

-

Over a recent three-year period, the average annual return on a portfolio was 20 percent and the annual return standard deviation for the portfolio was 25 percent. During the same period, the average...

-

Prob. 1(a). Consider a stock currently trading at $40.25. For a strike price of $38, you want to price both a call and put option that matures 90 days from now. The volatility of the stock (2) is...

-

Wildhorse sells a snowboard, WhiteOut, that is popular with snowboard enthusiasts. Presented below is information relating to Wildhorse's purchases of WhiteOut snowboards during September. During the...

-

The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses:...

Study smarter with the SolutionInn App