In Problem 6, assume the fund is sold with a 6.25 percent front-end load. What is the

Question:

Data From Problem 6

Suppose the fund in Problem 5 has liabilities of $110,000. What is the NAV of the fund now?

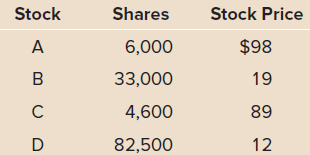

An open-end mutual fund has the following stocks:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: