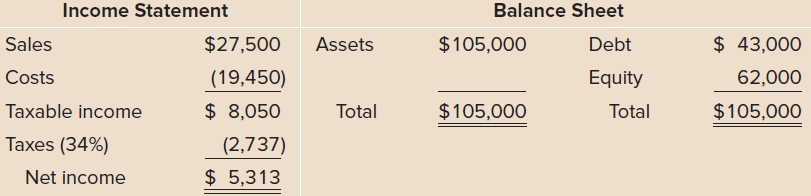

The most recent financial statements for Martin, Inc., are shown here: Assets and costs are proportional to

Question:

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $850 was paid, and Martin wishes to maintain a constant payout ratio. Next year€™s sales are projected to be $31,625. What is the external financing needed?

Financial Statements

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $850 was paid, and Martin wishes to maintain a constant payout ratio. Next year€™s sales are projected to be $31,625. What is the external financing needed?

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: