Which of the following is closest to the expected return of the clients portfolio if 10 percent

Question:

a. 11 percent

b. 10.2 percent

c. 11.8 percent

Andy Green, CFA, and Sue Hutchinson, CFA, are considering adding alternative investments to the portfolio they manage for a private client. After much discussion, they have decided to add a hedge fund to the portfolio. In their research, Mr. Green focuses on hedge funds that have the highest returns, while Ms. Hutchinson focuses on finding hedge funds that can reduce portfolio risk while maintaining the same level of return.

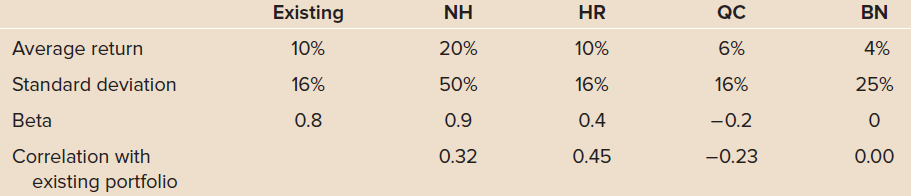

After completing their research, Mr. Green proposes two funds: the New Horizon Emerging Market Fund (NH), which takes long-term positions in emerging markets, and the Hi Rise Real Estate Fund (HR), which holds a highly leveraged real estate portfolio. Ms. Hutchinson proposes two hedge funds: the Quality Commodity Fund (QC), which takes conservative positions in commodities, and the Beta Naught Fund (BN), which manages an equity long/short portfolio that targets a market risk of zero. The table below details the statistics for the existing portfolio, as well as for the four potential funds. The standard deviation of the market€™s return is 18 percent.

Mr. Green and Ms. Hutchinson have agreed to select the fund that will provide a portfolio with the highest return-to-risk ratio (i.e., average return relative to standard deviation). They have decided to invest 10 percent of the portfolio in the selected fund.

As an alternative to one fund, Mr. Green and Ms. Hutchinson have discussed investing 5 percent in the Beta Naught Fund (BN) and 5 percent in one of the other three funds. This new 50/50 hedge fund would then serve as the 10 percent allocation in the portfolio.

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin