Costco's selling, general, and administrative expenses (SG&A expenses) remained steady between 8.7% to 8.8% of net sales

Question:

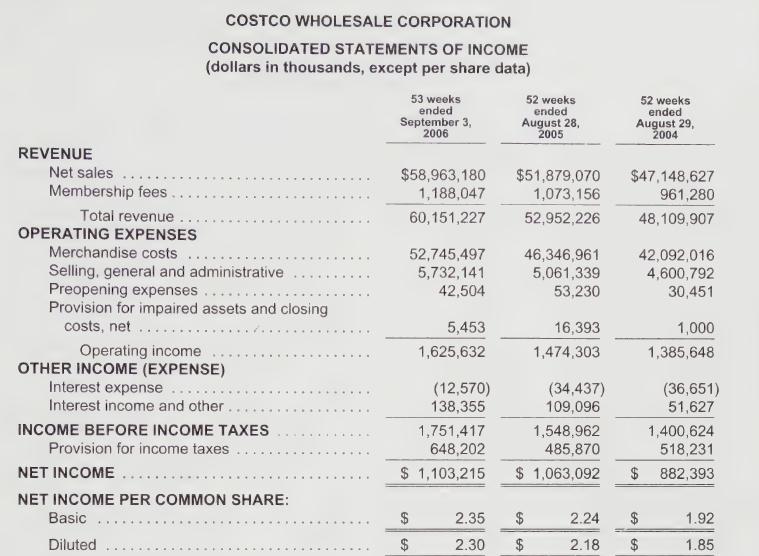

Costco's selling, general, and administrative expenses (SG&A expenses) remained steady between 8.7% to 8.8% of net sales during fiscal years 1994 and 2000. Then, in 2001, these expenses began to rise, reaching a high of 9.83% of net sales in 2003. Citing rising costs for healthcare, workers' compensation, and salaries, Costco's top officers state in their 2003 annual report, "These figures are unacceptable, and we are working hard to reverse this trend." Has management been successful in reversing this trend and have their efforts had a significant impact on the company?

Instructions:

Calculate the following items, rounding amounts to the nearest million dollars:

1. Calculate how much SG&A expenses would have been in 2006 if Costco had been unsuccessful in reducing expenses from 9.83% of net sales.

2. Calculate the increase in income before federal income taxes that resulted from Costco reducing its 2006 SG&A expenses as a percent of sales.

3. Costco's effective tax rate was 37.0% in 2006, meaning that \($37.00\) of taxes were paid on every \($100.00\) of income before federal income taxes. Calculate the increase in net income of the reduction in SG&A expenses.

4. Calculate the increase in the basic earnings per share. Obtain the number of common basic shares in the income statement on page B-7 of Appendix B.

5. Do you believe Costco's management has done a good job of getting its SG&A expenses under control? How, in your opinion, will their recognition of this problem be perceived by current and potential investors? Support your answer.

Data from page B-7 of Appendix B

Step by Step Answer: