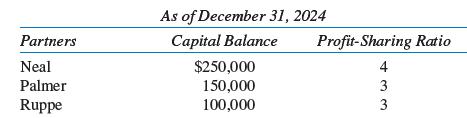

Neal, Palmer, and Ruppe are partners in a real estate company. Their respective capital balances and profit

Question:

Neal, Palmer, and Ruppe are partners in a real estate company. Their respective capital balances and profit sharing ratios are as follows:

Neal wishes to withdraw from the partnership on January 1, 2025, Palmer and Ruppe have agreed to pay Neal $300,000 from the partnership assets for his 50% capital interest. This settlement price was based on such factors as capital investments, sales performance, and earning capacity. Palmer and Ruppe must decide whether to use the bonus method or the goodwill method (recognize total goodwill implied by the payment) to record the withdrawal, and they wish to compare the results of using the two methods.

Required:

Prepare a comparison of capital balances using the bonus and goodwill methods (and writing off goodwill implied due to subsequent impairment), assuming that

1. The new profit and loss ratio is in the same relative ratio as that existing before Neal’s withdrawal.

2. The profit and loss ratio is changed to 3:2. Palmer is particularly interested in these results, because he feels that his present contribution of time and capital is better reflected by this new profit and loss ratio.

Step by Step Answer: