Numerous accounting principles require companies to discount future cash flows when estimating amounts that are reported on

Question:

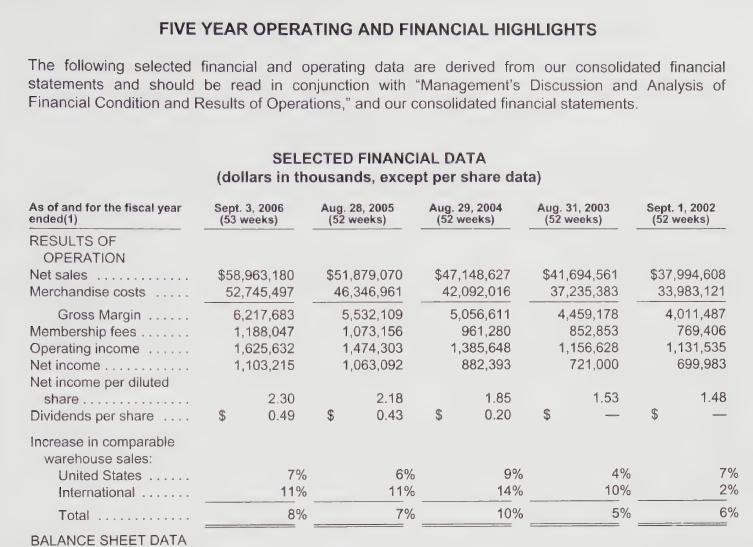

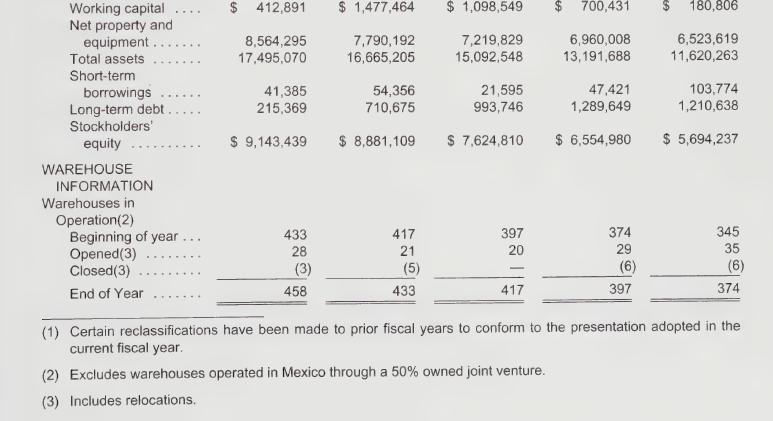

Numerous accounting principles require companies to discount future cash flows when estimating amounts that are reported on financial statements. For example, the present value of a \($10,000\) account receivable expected to be collected in two years should be reported on the balance sheet as \($8,570,\) assuming an 8% discount rate. Accounting principles require companies to write down the value of plant assets if the fair value of the assets is less than the recorded book value. When establishing these accounting principles, the Financial Accounting Standards Board (FASB) considered how present values should be applied to this situation. Costco presents its application of the FASB rules in the section "Impairment of Long-Lived Assets" of Note 1 on page B-12.

1. Does the FASB require Costco to discount future cash flows related to asset impairments? Support your answer.

2. Did Costco write down any plant assets during the period 2004 to 2006?

Data from page B-12.

Step by Step Answer: