The following information is taken from the records of Cozart Company on July 31 of the current

Question:

The following information is taken from the records of Cozart Company on July 31 of the current year. The accounts and balances needed to complete this problem are provided in the Working Papers.

a. The total factory payroll for the month from the payroll register is \($63,000.00,\) distributed as follows.

b. The total of all requisitions of direct materials issued during the month is \($67,760.00.\) The total of all requisitions of indirect materials issued during the month is \($6,990.00.\)

c. The factory overhead to be charged to Work in Process is 95% of the direct labor cost.

d. The total of all cost sheets completed during the month is \($140,984.00.\)

e. The total of costs recorded on all sales invoices for July is \($112,176.83.\)

Instructions:

1. Journalize the factory payroll entry on page 14 of a cash payments journal. C341. Post the general debit and general credit amounts.

2. Journalize the following entries on page 7 of a general journal. Post the entries.

a. An entry to transfer the total of all direct materials requisitions to Work in Process and indirect materials to Factory Overhead. M698.

b. An entry to close all individual manufacturing expense accounts to Factory Overhead. M699.

c. An entry to record applied factory overhead to Work in Process. M700.

3. Continue using page 7 of the general journal. Journalize and post the entry to close the balance of the factory overhead account to Income Summary. M701.

4. Journalize and post the entry to transfer the total of all cost sheets completed from Work in Process to Finished Goods. M702.

5. Journalize and post the entry to transfer the cost of products sold from Finished Goods to Cost of Goods Sold. M703.

6. Prepare a statement of cost of goods manufactured for the month ended July 31 of the current year.

Cozart’s general ledger accounts and their balances on July 31 of the current year are given on the work sheet in the Working Papers. (The Employee Income Tax Payable, Social Security Tax Payable, and Medicare Tax Payable balances differ from your ledger account balances due to additional postings completed for payroll taxes and sales and administrative salaries.)

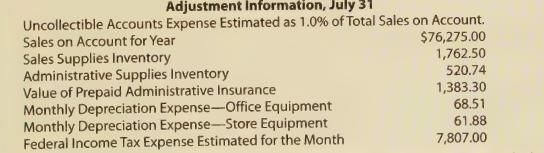

7. Prepare an 8-column work sheet for the month ended July 31 of the current year. Record the adjustments on the work sheet using the following information.

8. Prepare an income statement for the month ended July 31 of the current year. Calculate and record the following component percentages:

(a) net cost of goods sold,

(b) gross profit on operations,

(c) total operating expenses,

(d) income from operations,

(e) net addition or deduction resulting from other revenue and expenses,

(f) net income before federal income tax, (g) federal income tax expense, and (h) net income after federal income tax. Round percentage calculations to the nearest 0.1 %.

9. Prepare a balance sheet for July 31 of the current year. A statement of stockholders’ equity is not prepared.

Therefore, add the amount of net income after federal income tax to the beginning balance of Retained Earnings to obtain the ending balance.

Step by Step Answer: