Consider a simple firm that has the following market-value balance sheet: Next year, there are two possible

Question:

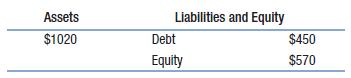

Consider a simple firm that has the following market-value balance sheet:

Next year, there are two possible values for its assets, each equally likely: $1220 and $970. Its debt will be due with 5.1% interest. Because all of the cash flows from the assets must go either to the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm’s capital structure, your portfolio should earn exactly the expected return on the firm’s assets. Show that a portfolio invested 44% in the firm’s debt and 56% in its equity will have the same expected return as the assets of the firm. That is, show that the firm’s pretax WACC is the same as the expected return on its assets.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford