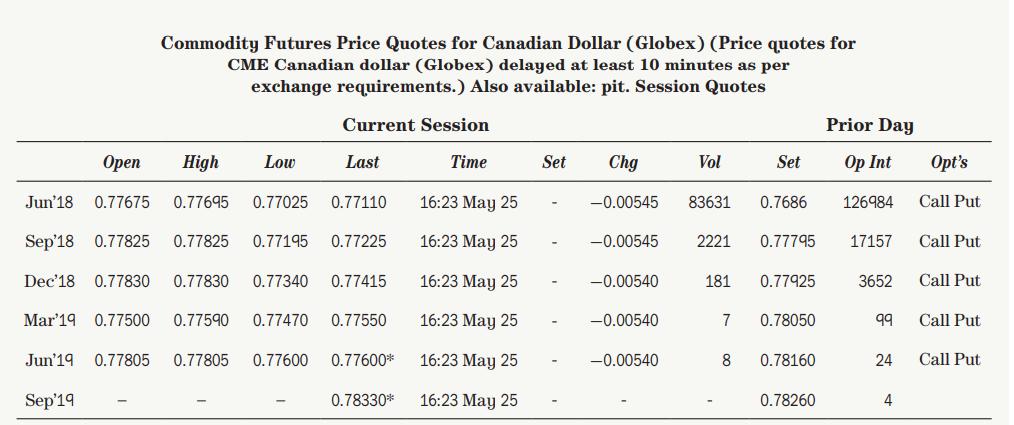

Refer to Figure 24.6 in the text to answer this question. If a Canadian company exports its

Question:

Refer to Figure 24.6 in the text to answer this question. If a Canadian company exports its goods to the U.S., how would it use a U.S.–traded futures contract on Canadian dollars to hedge its exchange rate risk? Would it buy or sell Canadian dollar futures? In answering, pay attention to how the exchange rate is quoted in the futures contract.

Data in Figure 24.6

Transcribed Image Text:

Commodity Futures Price Quotes for Canadian Dollar (Globex) (Price quotes for CME Canadian dollar (Globex) delayed at least 10 minutes as per exchange requirements.) Also available: pit. Session Quotes Low Current Session Open High Jun'18 0.77675 0.77695 Sep'18 0.77825 0.77825 0.77195 0.77225 Dec'18 0.77830 0.77830 0.77340 0.77415 0.77550 Mar 19 0.77500 0.77590 0.77470 Jun'19 0.77805 0.77805 0.77600 0.77600* Sep'19 0.77025 Last 0.77110 0.78330* Time 16:23 May 25 16:23 May 25 16:23 May 25 16:23 May 25 16:23 May 25 16:23 May 25 Set Chg -0.00545 -0.00540 -0.00540 Vol -0.00540 83631 -0.00545 2221 0.77795 181 7 Set 8 0.7686 0.77925 0.78050 0.78160 0.78260 Prior Day Op Int 126984 17157 3652 99 24 4 Opt's Call Put Call Put Call Put Call Put Call Put

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

The risk is that the Canadian dollar will strengthen ...View the full answer

Answered By

Ehsan Mahmood

I’ve earned Masters Degree in Business Studies and specialized in Accounts & Finance. Couple with this, I have earned BS Sociology from renowned institute of Pakistan. Moreover, I have humongous teaching experience at Graduate and Post-graduate level to Business and humanities students along with more than 7 years of teaching experience to my foreign students Online. I’m also professional writer and write for numerous academic journals pertaining to educational institutes periodically.

4.90+

248+ Reviews

287+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781259654756

10th Canadian Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan, Gordon Roberts, J. Ari Pandes, Thomas Holloway

Question Posted:

Students also viewed these Business questions

-

Refer to Table 23.1 in the text to answer this question. Suppose you purchase a July 2014 cocoa futures contract this day, at the last price of the day. What will your profit or loss be if cocoa...

-

Refer to Table 23.1 in the text to answer this question. Suppose you sell five May 2014 silver futures contracts this day at the last price of the day. What will your profit or loss be if silver...

-

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the June 2014 call option on com futures with a strike price of $5.05. Assume you purchased the future at the last price....

-

You have recently been hired as a fund manager in the portfolio management team of a bank. Your Director, John Tan has arranged a meeting next week to present an investment proposal to a prospective...

-

Find the sampling distribution of the median for random samples of size 2m+ 1 from the population of Exercise 8.46.

-

Which of the following is a correct statement about entity integrity rule? a. The rule is regarding how to use foreign keys. b. The rule is used to verify the type of data values in each table. c....

-

Refer to the information in Problem 21-1B. Tohono Companys actual income statement for 2017 follows. Required 1. Prepare a flexible budget performance report for 2017. Analysis Component 2. Analyze...

-

Nagoya Amusements Corporation places electronic games and other amusement devices in supermarkets and similar outlets throughout Japan. Nagoya Amusements is investigating the purchase of a new...

-

2. The armadillo is known as one of the world's fastest land animals. On one particular occasion, a biologist observed an armadillo named [N57E] for 6.00 s. The armadillo then ran 19.0 m [N23W]. What...

-

This question deals with the properties of possible worlds, defined on page 488 as assignments to all random variables. We will work with propositions that correspond to exactly one possible world...

-

Suppose a firm enters into a fixed-for-floating interest rate swap with a swap dealer. Describe the cash flows that will occur as a result of the swap.

-

In the previous problem, construct the statement of financial position for the new corporation, assuming that the transaction is treated as a purchase for accounting purposes. The market value of...

-

Assets and liabilities are important elements of a companys financial position. a. Define assets. Give three examples of assets other than cash that might appear in the balance sheet of (1) American...

-

Which certification may be required to become a chief investment officer? Certified Management Accountant (CMA) Certified Internal Auditor (CIA) Chartered Financial Analyst (CFA) Chartered Global...

-

If the bit pattern is 101010101110, how does the waveform appear on an RS232 port? For the bit pattern 10101010100, draw the waveforms for Bipolar AMI and Manchester encoding schemes. Is it possible...

-

After the January 6, 2021 disturbance at the United States Capitol building, a number of members of a group called the Proud Boys were indicted under various criminal statutes. They have now claimed...

-

How should a decision-maker choose the appropriate basis for decision making (substantive, political, or organizational)? Can any general guidelines be suggested? What factors enter into this kind of...

-

5. Write the following in minimal SOP form a) AB + CD (AB' + CD) b) AB (B'C' + BD) c) A + B[AC + (B + C')D] 6. Convert the SOP expressions from problem 5 to canonical SOP form 7. Convert the...

-

When price elasticity is -1.5 to -2, why would a price reduction result in larger volumes, higher market share, and greater sales but lower profits?

-

How can a promoter avoid personal liability for pre-incorporation contracts?

-

Define book-value accounting and market-value accounting.

-

Compare and contrast depreciation expense and amortization expense.

-

Why are retained earnings not considered an asset of the firm?

-

XS Supply Company is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income...

-

How long does the recursive multiplication algorithm (discussed in the class) take to multiply an n-bit number by an m-bit number?

-

The following information is from ABC Companys general ledger: Beginning and ending inventories, respectively, for raw materials were $9,500 and $11,500 and for work in process were $21,500 and...

Study smarter with the SolutionInn App