Wagner, Inc., is a private company that designs, manufactures, and distributes branded consumer products. During its most

Question:

Wagner, Inc., is a private company that designs, manufactures, and distributes branded consumer products.

During its most recent fiscal year, Wagner had revenues of $325 million and earnings of $15 million.

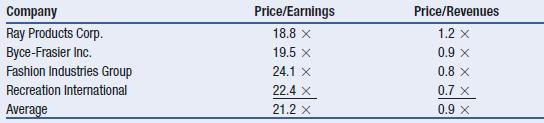

Wagner has filed a registration statement with the SEC for its IPO. Before the stock is offered, Wagner’s investment bankers would like to estimate the value of the company using comparable companies. The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public. In each case, the ratios are based on the IPO price.

After the IPO, Wagner will have 20 million shares outstanding. Estimate the IPO price for Wagner using the price/earnings ratio and the price/revenues ratio.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford