Assuming that KMSs market share will increase by 0.25% per year (implying that the investment, financing, and

Question:

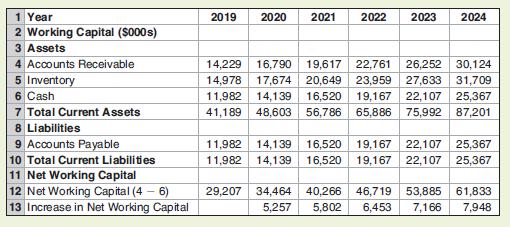

Assuming that KMS’s market share will increase by 0.25% per year (implying that the investment, financing, and depreciation will be adjusted as described in Problems 13 and 14), and that the working capital assumptions used in the chapter still hold, calculate KMS’s working capital requirements through 2024 (that is, reproduce Table 18.9 under the new assumptions).

Data from problem 13

Under the assumption that KMS’s market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2021. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10 year bond and interest rates remain the same as in the chapter) through 2024.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780135811603

5th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford