In the previous problem, suppose the company instead decides on a four-for-one stock split. The firms 60-cent

Question:

In the previous problem, suppose the company instead decides on a four-for-one stock split. The firm’s 60-cent per share cash dividend on the new (post-split) shares represents an increase of 10 percent over last year’s dividend on the pre-split stock. What effect does this have on the equity accounts? What was last year’s dividend per share?

Data from Previous Problem

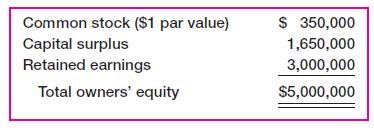

The company with the common equity accounts shown here has declared an 8 percent stock dividend at a time when the market value of its stock is $20 per share. What effects on the equity accounts will the distribution of the stock dividend have?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

Question Posted: