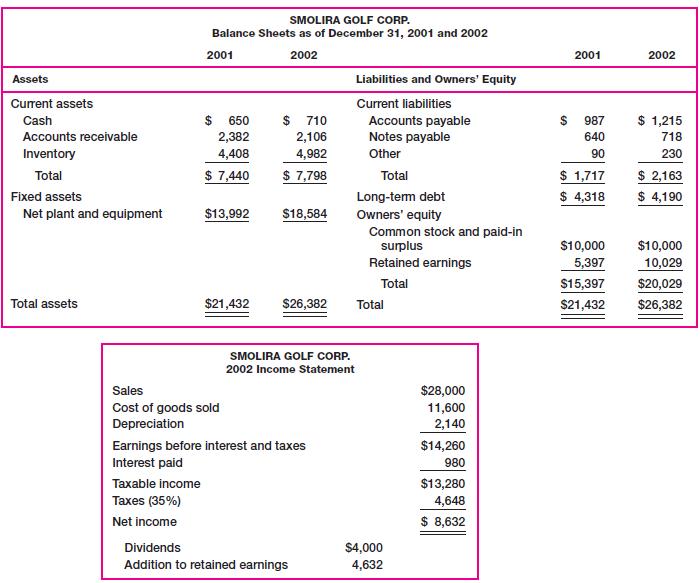

Some recent financial statements for Smolira Golf Corp. follow. For how many days could Smolira Golf Corp.

Question:

Some recent financial statements for Smolira Golf Corp. follow.

For how many days could Smolira Golf Corp. continue to operate if its cash inflows were suddenly suspended?

Transcribed Image Text:

Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets SMOLIRA GOLF CORP. Balance Sheets as of December 31, 2001 and 2002 2002 2001 Taxable income Taxes (35%) Net income $ 650 2,382 4,408 $ 7,440 $13,992 $21,432 Sales Cost of goods sold Depreciation 710 2,106 4,982 $ 7,798 $18,584 Earnings before interest and taxes Interest paid Liabilities and Owners' Equity Current liabilities SMOLIRA GOLF CORP. 2002 Income Statement Dividends Addition to retained earnings Accounts payable Notes payable Other $26,382 Total Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total $4,000 4,632 $28,000 11,600 2,140 $14,260 980 $13,280 4,648 $ 8,632 2001 987 640 90 $ 1,717 $ 4,318 $10,000 5,397 $15,397 $21,432 2002 $ 1,215 718 230 $ 2,163 $ 4,190 $10,000 10,029 $20,029 $26,382

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

To determine how many days Smolira Golf Corp could continue to operate if its cash inflows were sudd...View the full answer

Answered By

Mary Boke

As an online tutor with over seven years of experience and a PhD in Education, I have had the opportunity to work with a wide range of students from diverse backgrounds. My experience in education has allowed me to develop a deep understanding of how students learn and the various approaches that can be used to facilitate their learning. I believe in creating a positive and inclusive learning environment that encourages students to ask questions and engage with the material. I work closely with my students to understand their individual learning styles, strengths, and challenges to tailor my approach accordingly. I also place a strong emphasis on building strong relationships with my students, which fosters trust and creates a supportive learning environment. Overall, my goal as an online tutor is to help students achieve their academic goals and develop a lifelong love of learning. I believe that education is a transformative experience that has the power to change lives, and I am committed to helping my students realize their full potential.

5.00+

4+ Reviews

21+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

Question Posted:

Students also viewed these Business questions

-

For how many days could Earl Grey Golf Corp. continue to operate if its cash inflows were suddenly suspended? EARL GREY GOLF CORP. 2011 and 2012 Statement of Financial Position Liabilities and...

-

An object's momentum changed from (-5.0. 1) kg m/s to (14,-14,-4) kg m/s in 1.6s. The object's mass is 5.5 kg. How much work was done on this object during this time? work-

-

While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE),...

-

Write code in MATLAB (Radionuclide) (half-life) U-238 4.468 x 10 years U-235 703.8 x 10 years Mo-99 67 hours Tc-99m 6.04 hours Given the formula, where is the decay constant used in , calculate the...

-

Jack Hodges, accountant for Edible Pie Foods, was injured in an auto accident. Another employee prepared the following income statement for the fiscal year ended June 30, 2010: The individual amounts...

-

How does expertise affect problem solving?

-

1. What are the characteristics of a partnership?

-

On May 1, Johnson Corporation purchased inventory for $40,000 on credit. On May 15, Johnson sold inventory with a cost of $10,000 for $25,000 on credit. Prepare journal entries to record these...

-

3) Thomason Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (1,000 units) Variable expenses...

-

Some recent financial statements for Smolira Golf Corp. follow. Prepare the 2002 statement of cash flows for Smolira Golf Corp. Assets Current assets Cash Accounts receivable Inventory Total Fixed...

-

Some recent financial statements for Smolira Golf Corp. follow. Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): Assets...

-

Use the following figure to answer the following questions. Does rectangle ABCD have 90 rotational symmetry about point P? Explain B

-

Small town Diners has a policy of treating dividends as a passive residual. It forecasts that net earnings after taxes in the coming year will be $500,000. The firm has earned the same $500,000 for...

-

Part 1-Chi-Square Goodness-of-Fit Tests A health psychologist was interested in women's workout preferences. Of the 56 participants surveyed, 22 preferred running, 8 preferred swimming, 15 preferred...

-

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,070,000, and it would cost another $21,000 to install it. The machine falls...

-

Problem 1. (10 points) Consider the space X = R22 and the map L XX defined as traceX -traceX L:X X = X 0 0 1. Show that L is a linear map; 2. Find the matrix representation M = mat L in the canonical...

-

Suppose that the exchange rate is 1.25 = 1.00. Options (calls and puts) are available on the Philadelphia exchangein units of10,000 with strike prices of $1.60/1.00. Options (calls and puts) are...

-

The accompanying table lists results of overtime football games before and after the overtime rule was changed in the National Football League in 2011. Use a 0.05 significance level to test the claim...

-

Conduct a VRIO analysis by ranking Husson University (in Maine) business school in terms of the following six dimensions relative to the top three rival schools. If you were the dean with a limited...

-

Full-Capacity Sales Seaweed Mfg., Inc., is currently operating at only 90 percent of fixed asset capacity. Current sales are $610,000. How fast can sales grow before any new fixed assets are needed?

-

Fixed Assets and Capacity Usage For the company in the previous problem, suppose fixed assets are $470,000 and Sales are projected to grow to $710,000. How much in new fixed assets are required to...

-

Growth and Profit Margin Fixed Appliance Co. wishes to maintain a growth rate of 12 percent a year, a debtequity ratio of .60, and a dividend payout ratio of 30 percent. The ratio of total assets to...

-

Show that the convexity for a zero coupon bond with m payments per year is (m) n(n + -)(1+ m m

-

Abdul Canarte , a Central Bank economist, noticed that the total group purchasing basket of goods (CPI) has gone from $149,740.00 to $344,460.00 in 8 years. With monthly compounding, what is the...

-

ABC Corporation expects sales next year to be $50,000,000. Inventory and accounts receivable (combined) will increase $8,000,000 to accommodate this sales level. The company has a profit margin of 6...

Study smarter with the SolutionInn App