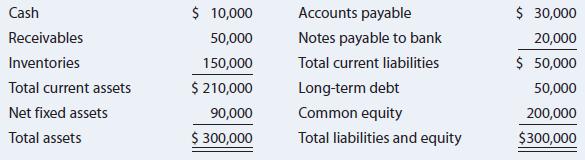

Lloyd Inc. has sales of $200,000, a net income of $15,000, and the following balance sheet: The

Question:

Lloyd Inc. has sales of $200,000, a net income of

$15,000, and the following balance sheet:

The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 2.53, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 2.53), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? What will be the firm’s new quick ratio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: