You have applied for a job with a local bank. As part of its evaluation process, you

Question:

You have applied for a job with a local bank. As part of its evaluation process, you must take an examination on time value of money analysis covering the following questions.

a. Draw time lines for (1) a $100 lump sum cash flow at the end of Year 2, (2) an ordinary annuity of $100 per year for 3 years, and (3) an uneven cash flow stream of $50, $100, $75, and $50 at the end of Years 0 through 3.

b. (1) What’s the future value of $100 after 3 years if it earns 10 percent, annual compounding? (2) What’s the present value of $100 to be received in 3 years if the interest rate is 10 percent, annual compounding?

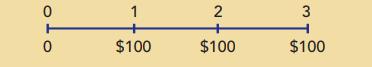

c. What annual interest rate would cause $100 to grow to $125.97 in 3 years? d. If a company’s sales are growing at a rate of 20 percent annually, how long will it take sales to double? e. What’s the difference between an ordinary annuity and an annuity due? What type of annuity is shown here? How would you change it to the other type of annuity?  f. (1) What is the future value of a 3-year, $100 ordinary annuity if the annual interest rate is 10 percent?

f. (1) What is the future value of a 3-year, $100 ordinary annuity if the annual interest rate is 10 percent?

(2) What is its present value?

(3) What would the future and present values be if it were an annuity due?

g. A 5-year $100 ordinary annuity has an annual interest rate of 10 percent.

(1) What is its present value?

(2) What would the present value be if it was a 10-year annuity?

(3) What would the present value be if it was a 25-year annuity?

(4) What would the present value be if this was a perpetuity?

h. A 20-year-old student wants to save $3 a day for her retirement. Every day she places $3 in a drawer. At the end of each year, she invests the accumulated savings ($1,095) in a brokerage account with an expected annual return of 12 percent.

(1) If she keeps saving in this manner, how much will she have accumulated at age 65?

(2) If a 40-year-old investor began saving in this manner, how much would he have at age 65?

(3) How much would the 40-year-old investor have to save each year to accumulate the same amount at 65 as the 20-year-old investor?

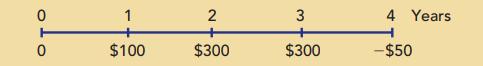

i. What is the present value of the following uneven cash flow stream? The annual interest rate is 10 percent.  j. (1) Will the future value be larger or smaller if we compound an initial amount more often than annually, for example, semiannually, holding the stated (nominal) rate constant? Why?

j. (1) Will the future value be larger or smaller if we compound an initial amount more often than annually, for example, semiannually, holding the stated (nominal) rate constant? Why?

(2) Define (a) the stated, or quoted, or nominal, rate, (b) the periodic rate, and (c) the effective annual rate (EAR or EFF%).

(3) What is the EAR corresponding to a nominal rate of 10 percent compounded semiannually? Compounded quarterly? Compounded daily?

(4) What is the future value of $100 after 3 years under 10 percent semiannual compounding? Quarterly compounding? k. When will the EAR equal the nominal (quoted) rate?

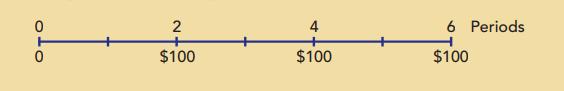

l. (1) What is the value at the end of Year 3 of the following cash flow stream if interest is 10 percent, compounded semiannually?  (2) What is the PV?

(2) What is the PV?

(3) What would be wrong with your answer to parts l(1) and l(2) if you used the nominal rate, 10 percent, rather than either the EAR or the periodic rate, INOM/2 10%/2 5% to solve them?

m. (1) Construct an amortization schedule for a $1,000, 10 percent annual interest loan with 3 equal installments.

(2) What is the annual interest expense for the borrower, and the annual interest income for the lender, during Year 2?

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9781111795207

11th Edition

Authors: Richard Bulliet, Eugene F Brigham, Brigham/ Houston