Katie plans to form a portfolio consisting of two securities, Intel (INTC) and Procter & Gamble (PG),

Question:

Katie plans to form a portfolio consisting of two securities, Intel (INTC) and Procter & Gamble (PG), and she wonders how the portfolio’s return will depend on the amount that she invests in each stock. Katie’s professor suggests that she use the capital asset pricing model to define the required returns for the two companies.

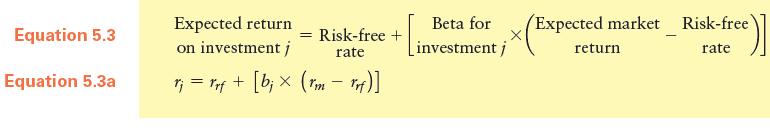

Katie measures rrf using the current long-term Treasury bond return of 5%. Katie determines that the average return on the S&P 500 Index over the last several years is 6.1%, so she uses that figure to measure rm. She researches a source for the beta information and follows these steps:

• Go to http://money.msn.com

• In the Get Quote box, type INTC and press Get Quote.

• On the next page, look for the stock’s beta.

• Repeat the steps for the PG stock.

Questions

a. What are the beta values for INTC and PG? Using the CAPM, create a spreadsheet to determine the required rates of return for both INTC and PG.

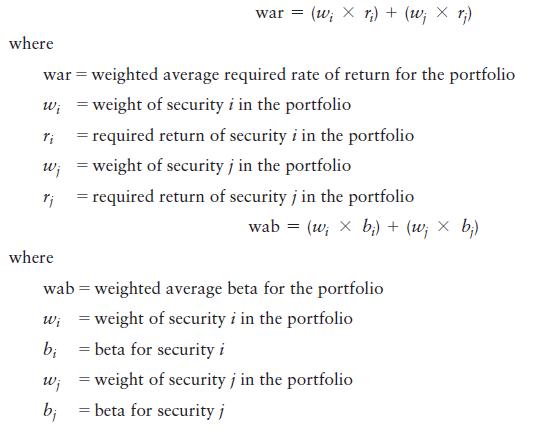

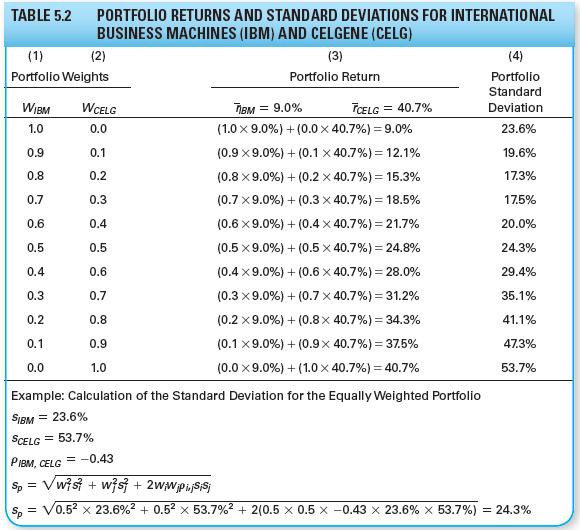

b. Katie has decided that the portfolio will be distributed between INTC and PG in a 60% and 40% split, respectively. Hence, a weighted average can be calculated for both the returns and betas of the portfolio. This concept is shown in the spreadsheet for Table 5.2, which can be viewed at http://www.myfinancelab.com. Create a spreadsheet using the following models for the calculations:

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk