a. Suppose a $100,000 mortgage financed at 9 percent (.75 percent monthly) is paid off in the

Question:

a. Suppose a $100,000 mortgage financed at 9 percent (.75 percent monthly) is paid off in the first month after issuance. In this case, what are the cash flows to an IO strip and a PO strip from this mortgage?

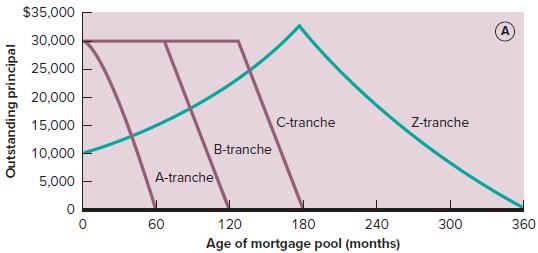

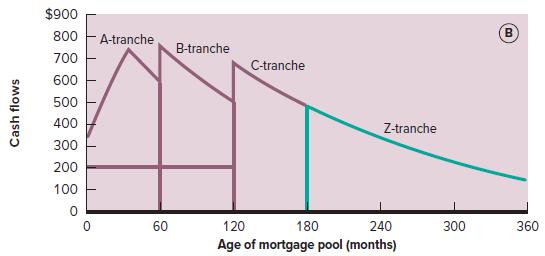

b. Figures 21.5A and 21.5B assume a 100 PSA prepayment schedule. How would these figures change for a 200 PSA prepayment schedule or a 50 PSA prepayment schedule?

c. While A-, B-, and C-tranche principal is being paid down, Z-tranche interest is used to acquire principal for the Z-tranche. What is the growth rate of Z-tranche principal during this period?

Figures 21.5A

Figures 21.5B

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: