a. Suppose the stock price today is $95, not $100 as shown in Figure 16.1. Nothing else

Question:

a. Suppose the stock price today is $95, not $100 as shown in Figure 16.1. Nothing else changes in the detailed example that follows Figure 16.1. Does delta still equal .67? What is the call price?

b. You calculate a delta of .8. How many shares and calls are needed to form a risk-free portfolio? What positions (i.e., long or short) does the investor have in shares and calls?

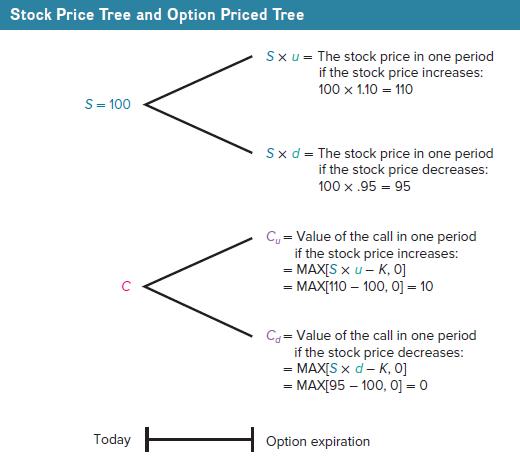

Figure 16.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: