In Example 11.3, what are the standard deviations of the two portfolios? Example 11.3 Suppose we had

Question:

In Example 11.3, what are the standard deviations of the two portfolios?

Example 11.3

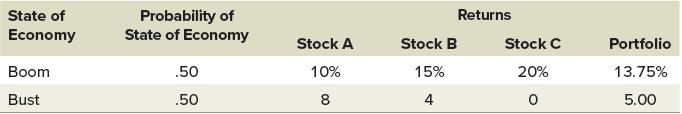

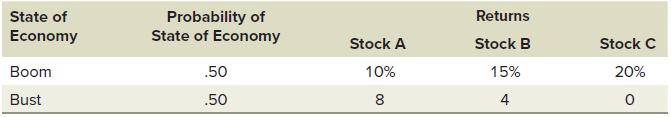

Suppose we had the following projections on three stocks:

We want to calculate portfolio expected returns in two cases. First, what would be the expected return on a portfolio with equal amounts invested in each of the three stocks? Second, what would be the expected return if half of the portfolio were in A, with the remainder equally divided between B and C?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: