In Example 3.4, you bought two Nike 140 put contracts for $562. Suppose that the expiration date

Question:

In Example 3.4, you bought two Nike 140 put contracts for $562. Suppose that the expiration date arrives and Nike is selling for $130 per share. How did you do? What’s the break-even stock price, that is, the stock price at which you just make enough to cover your $562 cost?

Example 3.4

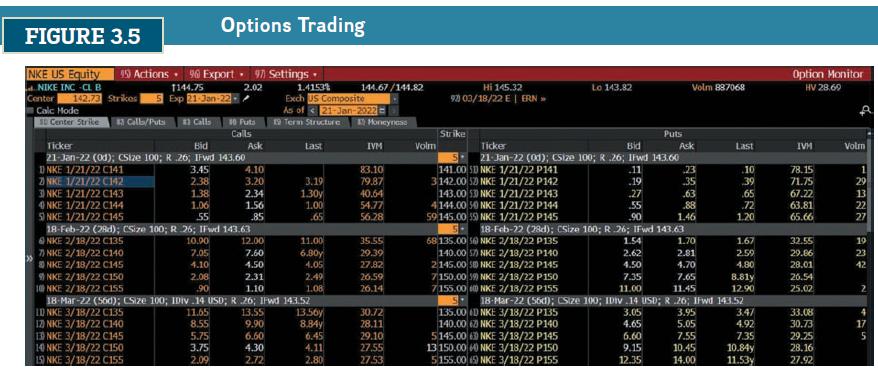

Suppose you want the right to sell 200 shares of Nike sometime before February 18, 2022, at a price of $140. In light of the information in Figure 3.5, what contract should you buy? How much will it cost you?

Figure 3.5

Transcribed Image Text:

FIGURE 3.5 NKE US Equity 5 Actions 90 Export. 97 Settings. NIKE INC-CL B 1144.75 2.02 142.73 Strikes Exp 21-Jan-22- Center Calc Mode 10 Center Strike Calls/Puts Calls 1) NKE 1/21/22 C141 2NKE 1/21/22 C142 3NKE 1/21/22 C143 4 NKE 1/21/22 C144 SNKE 1/21/22 C145 Ticker Bid 21-Jan-22 (08); CSize 100; R.26; IFwd 143.60 3.45 2.38 1.38 1.06 55 Options Trading 10.90 7.05 4.10 2.08 .90 10 Futs Calls 11.65 8.55 5.75 3.75 2.09 Ask 18-Feb-22 (28d); CSize 100; R 26; IFwd 143.63 NKE 2/18/22 C135 7) NKE 2/18/22 C140 0 NIKE 2/18/22 C145 9NKE 2/18/22 C150 10 NIKE 2/18/22 C155 4.10 3.20 2.34 1.56 85 1.4153 Exch US Composite As of 21-Jan-2022 19 Term Structure Last 3.19 1.30y 1.00 .65 12.00 7.60 4.50 2.31 1.10 13.55 18-Mar-22 (560); CSize 100; IDiv.14 USD; R 26; IFwd 143.52 LDNKE 3/18/22 C135 12) NKE 3/18/22 C140 IRINKE 3/18/22 C145 14 NKE 3/18/22 C150 9.90 6.60 4.30 15) NKE 3/18/22 C155 2.72 11.00 6.30y 4.05 2.49 1.08 144.67/144.82 13.56y 8.84y 6.45 4.11 2.80 Honeynese IVM 83.10 79.87 40.64 54.77 56.28 35.55 29.39 27.82 26.59 26.14 30.72 28.11 29.10 27.55 27.53 Hi 145.32 92) 03/18/22 E | ERN >> Volm Strike Lo 143.82 Ticker Bid 11 19 21-Jan-22 (08); CSize 100; R.26; Ifwd 143.60 141.00 SD NKE 1/21/22 P141 3142.00 520) NKE 1/21/22 P142 143.00 530 NKE 1/21/22 P143 4144.00 50 NKE 1/21/22 P144 59 145.00 55) NKE 1/21/22 P145 27 55 90 18-Feb-22 (28d); CSize 100; R.26; IFwd 143.63 68135.00 50NKE 2/18/22 P135 140.0057) NKE 2/18/22 P140 2145.00 SD NKE 2/18/22 P145 7150.00 39) NKE 2/18/22 P150 7155.00 600 NIKE 2/18/22 P155 135.00 D NKE 3/18/22 P135 140.00 620 NKE 3/18/22 P140 5145.00 630NKE 3/18/22 P145 13 150.000 NKE 3/18/22 P150 5155.00 (5) NKE 3/18/22 P155 1.54 2.62 4.50 7.35 11.00 Puts 3.05 4.65 6.60 9.15 12.35 Volm 887068 Ask 23 35 .63 88 1.46 1.70 2.81 4.70 7.65 Last .10 39 .65 72 1.20 11.45 18-Mar-22 (56d); CSize 100; IDiv.14 USD; R .26; IFwd 143.52 3.95 5.05 7.55 10.45 14.00 1.67 2.59 4.80 8.81y 12.90 3.47 4.92 7.35 10.84y 11.53y Option Monitor HV 28.69 IVM 78.15 71.75 67.22 63.81 65.66 32.55 29.86 28.01 26.54 25.02 33.08 30.73 29.25 28.16 27.92 Volm BANN ANG 29 27 19 23 42 2475

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Your put contracts give you the right to sell 200 shares of Nike at a price of ...View the full answer

Answered By

Sultan Ghulam Dastgir

The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Use a software package such as Matlab or Mathematica to program the example described in section 7.3. (a) Assume the environmental regulator ignores the impact on the labor market and sets an...

-

A wire of mass 1 g and length 50 cm is stretched with a tension of 440 N. It is then placed near the open end of the tube in Example 16-8 and stroked with a violin bow so that it oscillates at its...

-

1. Create a service blueprint of the refinancing process. Why do you think the bank organized its process this way? What problems have ensued? 2. Examine the process carefully. Look at customer/...

-

A researcher hypothesizes that drivers who use cellular phones will get into a greater number of traffic accidents than drivers who do not use these phones. For this example, a. What are the...

-

The questions in this exercise give you an appreciation for the complexity of budgeting in a large multinational corporation. To answer the questions, you will need to download the Procter & Gamble...

-

7 TABLE 19-2 Life Insurance-Premium Term Insurance Permanent Insurance 5-Year Term 10-Year Term Whole 20-Payment 20-Year Life Life Endowment Factors Age Male Female Male Female Male Female Male...

-

Kitchen World Inc. is a Canadian controlled private corporation (CCPC) that operates a retail business selling cooking utensils, knives and small appliances for both professional chefs and home...

-

If you wanted to purchase the right to sell 2,000 shares of Target stock in March 2022 at a strike price of $210 per share, how much would this cost you?

-

You plan to purchase Nike call options with a strike price of $140 and a current ask premium of $3.75 per share. If you buy 10 contracts, how much will you pay? Suppose that just as the option is...

-

Identify the unknown species A Z X in the following nuclear reaction: 22 11 Na (d, a) A Z X. Here, d stands for the deuterium isotope 2 1 H of hydrogen.

-

The total power consumption by all humans on earth is approximately \(10^{13} \mathrm{~W}\). Let's compare this to the power of incoming solar radiation. The intensity of radiation from the sun at...

-

The volume control on a stereo is designed so that three clicks of the dial increase the output by \(10 \mathrm{~dB}\). How many clicks are required to increase the power output of the loudspeakers...

-

We can model the motion of a dragonfly's wing as simple harmonic motion. The total distance between the upper and lower limits of motion of the wing tip is \(1.0 \mathrm{~cm}\). The wing oscillates...

-

A woman wearing an in-ear hearing aid listens to a television set at a normal volume of approximately \(60 \mathrm{~dB}\). To hear it, she requires an amplification of \(30 \mathrm{~dB}\), so the...

-

Bats are sensitive to very small changes in frequency of the reflected waves. What information does this allow them to determine about their prey? A. Size B. Speed C. Distance D. Species As discussed...

-

Does deodorant sell better in a box or without additional packaging? An experiment in a large store is designed in which, for one month, all deodorants are sold packaged in a box and, during a second...

-

Show that, given a maximum flow in a network with m edges, a minimum cut of N can be computed in O(m) time.

-

Bond J is a 5 percent coupon bond. Bond K is a 9 percent coupon bond. Both bonds have 20 years to maturity and have a YTM of 7 percent. If interest rates suddenly rise by 2 percent, what is the...

-

Crosby Co. has 7.5 percent coupon bonds with a YTM of 6.84 percent. The current yield on these bonds is 7.13 percent. How many years do these bonds have left until they mature?

-

Suppose you buy a 7.5 percent coupon bond today for $1,080. The bond has 15 years to maturity. What rate of return do you expect to earn on your investment? Two years from now, the YTM on your bond...

-

Use the following MRP record to answer the question. Item: XYZ Lot size: P= 3 Lead time: 2 Description: weeks 1 2 3 4 5 6 7 8 Gross requirements 50 20 30 40 20 Scheduled 25 receipts Projected 50 on...

-

t Dt Ft 1 15 12 2 25 24 3 32 36 4 50 42 5 Your Answer: What would be the Mean Absolute Percentage Error (MAPE) of these four forecasts? (Round to one decimal position.) Answer units

-

Attendance at Victoria's newest theme park has been as follows; Year Quarter Guests(in 000's) 1 Winter 123 Spring 154 Summer 218 Fall 124 2 Winter 115 Spring 132 Summer 174 Fall 102 3 Winter 139...

Study smarter with the SolutionInn App