In Problem 14, suppose that Douglas McDonnell shareholders approve a 3-for-1 stock split on January 1, 2023.

Question:

In Problem 14, suppose that Douglas McDonnell shareholders approve a 3-for-1 stock split on January 1, 2023. What is the new divisor for the index? Calculate the rate of return on the index for the year ending December 31, 2023, if Douglas McDonnell’s share price on January 1, 2024, is $39.33 per share.

Problem 14

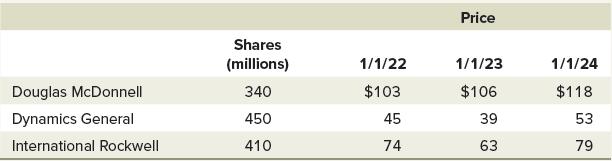

Suppose the following three defense stocks are to be combined into a stock index in January 2022 (perhaps a portfolio manager believes these stocks are an appropriate benchmark for their performance):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: