Using the relevant data in Example 6.13 and the residual income model, what discount rate, k, results

Question:

Using the relevant data in Example 6.13 and the residual income model, what discount rate, k, results in a price for ROCK of $66.68?

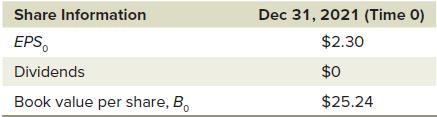

Example 6.13

Suppose we are evaluating Gibraltar Industries, Inc. (ROCK). In our analysis, we find that ROCK currently pays no dividends, so we conclude that we cannot use a dividend discount model. Thus, we decide to calculate a value using a residual income model, for which we collected the following data:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: