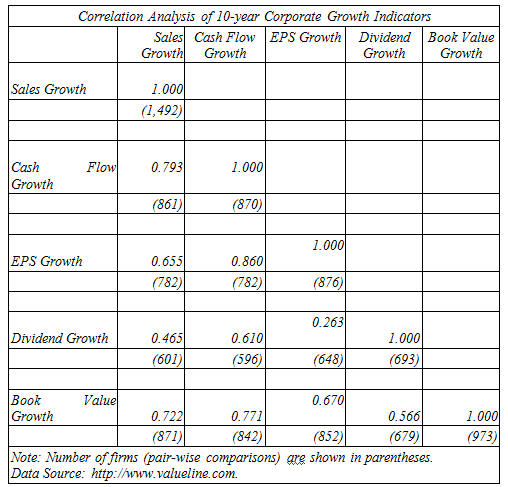

Correlation. Managers focus on growth rates for corporate assets and profitability as indicators of the overall health

Question:

The table shown here illustrates the correlation among these five key growth measures over a 10-year period for a sample of large firms taken from The Value Line Investment Survey.

A. This correlation table only shows one-half of the pair-wise comparisons between these five measures. For example, it shows that the correlation between the 10-year rates of growth in sales and cash flow is 0.793 (or 79.3 percent), but does not show the corresponding correlation between the 10-year rates of growth in cash flow and sales. Why?

B. Notice the correlation coefficients between EPS growth and the four remaining corporate growth indicators. Use your general business knowledge to explain these differences.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: