Assume that a non-dividend-paying stock has an expected return of (mu) and a volatility of (sigma). An

Question:

Assume that a non-dividend-paying stock has an expected return of \(\mu\) and a volatility of \(\sigma\). An innovative financial institution has just announced that it will trade a security that pays off a dollar amount equal to \(\ln S_{T}\) at time \(T\), where \(S_{T}\) denotes the value of the stock price at time \(T\).

(a) Use risk-neutral valuation to calculate the price of the security at time \(t\) in terms of the stock price, \(S\), at time \(t\).

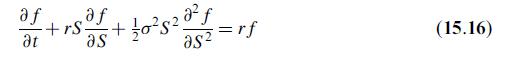

(b) Confirm that your price satisfies the differential equation (15.16).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: