On October 20 Job Connect received its bank statement dated October 18. 1. The checkbook balance on

Question:

On October 20 Job Connect received its bank statement dated October 18.

1. The checkbook balance on October 20 is $880.84.

2. The ending bank statement balance is $344.58.

3. A $14.00 service charge appears on the bank statement.

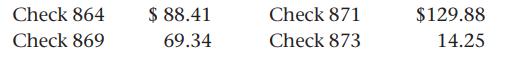

4. The following checks are outstanding:

5. A $68.42 check from Tom McCrary deposited on October 13 was returned by the bank for insufficient funds. The bank charged Job Connect’s account $7.00 for the NSF check. No journal entry was made for the NSF check.

6. A $938.72 deposit on October 19 is not on the bank statement.

7. A check for $200.00 to Fontenot Inc. was lost in the mail and has not been deposited. A stop payment order, which cost $10.00, was issued on October 15. No new check was issued.

Reconcile the bank statement using the account form in your working papers.

Step by Step Answer: