A city's ACFR indicated the following: Credit risk. As of September 30, the U.S. Treasuries and the

Question:

A city's ACFR indicated the following:

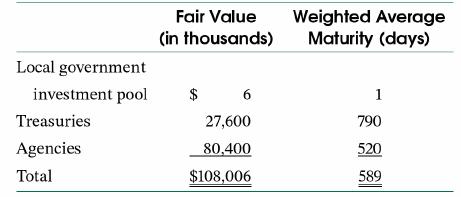

Credit risk. As of September 30, the U.S. Treasuries and the U.S. Agency Bonds were rated AAA by Standard & Poor's. The local government investment pool was rated AA.

Interest rate risk. As a means of minimizing risk of loss due to interest rate fluctuations, the investment policy requires that the dollar-weighted average maturity using final stated maturity dates shall not exceed seven years. The portfolio's weighted average maturity, however, may be substantially shorter if market conditions so dictate. As of September 30, the dollar-weighted average maturity was 589 days (1.61 years).

1. Why would the city limit the weighted average maturity of its portfolio to seven years rather than a greater number of years, even though investments with a longer maturity generally provide a greater investment yield?

2. Why might the city indicate that the average maturity of the local government investment pool is only one day when, in fact, the pool holds investments that have an average maturity of over 30 days?

3. What is meant by "credit risk"? How would you assess the credit risk of the U.S. Treasury and U.S. agency bonds? Explain.

Step by Step Answer:

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese