For each of the following indicate the amount of revenue that Beanville should recognize in its 20X2

Question:

For each of the following indicate the amount of revenue that Beanville should recognize in its 20X2

(1) Governmentwide statements and

(2) Governmental fund statements. Provide a brief justification or explanation for your responses.

1. The state in which Beanville is located collects sales taxes for its cities and other local governments. The state permits small merchants to remit sales taxes quarterly. The state sales tax rate is 6 percent. In December 20Xl, city merchants collected $50 million in sales taxes that they remitted to the state on January 15, 20X2. The state, in turn, transferred the taxes to the city on February 15, 20X2.

2. In December 20Xl, the federal government awarded Beanville a reimbursement grant of $500,000 to train law-enforcement agents. The city had applied for the grant in January of that year. The city may incur allowable costs any time after receiving notification of the award. In 20X2, the city incurred $400,000 in allowable costs and was reimbursed for $350,000. It was reimbursed for the $50,000 balance in February 20X3. In January and February 20X3, it incurred the remaining $100,000 in allowable costs and was reimbursed for them in April 20X3.

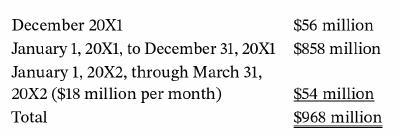

3. In December 20Xl, the city levied property taxes of $1 billion for the calendar year 20X2. The taxes are due on June 30, 20X2. The city collected these taxes as follows:

It estimates the balance of $32 million would be uncollectible. In addition, in the period from January 1 through February 28, 20X2, the city collected $16 million in taxes that were delinquent as of December 31, 20Xl. In the period March 1 through June 30 20X2, the city collected $8 million of taxes that were also delinquent as of December 31, 20Xl.

4. In December 20X2 Beanville sold a city-owned warehouse to a private developer. Sales price was $4.2 million. The warehouse had cost $4 million when it was acquired 10 years earlier. It had an estimated useful life of 40 years (with no salvage value).

5. In December 20X2, Beanville's city-owned radio station held its annual fund drive. A local business offered to match all pledges made on December 2, 20X2, up to $50,000, assuming that the amount pledged was actually collected. Based on past experience the city estimates that 90 percent of the pledges will actually be collected. By year-end 20X2, the city had collected $25,000 of the pledges, and in January and February it collected an additional $15,000. It received $25,000 of the matching funds on February 15, 20X3.

Step by Step Answer:

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese